9 What to Know Before you Re-finance The Home loan

21 юли, 2024

Private affairs much more crucial than simply latest financial pricing

Kirsten Rohrs Schmitt is an experienced elite editor, writer, proofreader, and you may reality-checker. She’s got experience in financing, spending, a residential property, and you can industry history. Throughout the the lady field, she’s created and you may modified content to have several user magazines and you may websites, designed resumes https://www.paydayloancolorado.net/flagler/ and you can social media blogs to own business owners, and authored equity getting academia and you may nonprofits. Kirsten is additionally the latest founder and you will manager of the Most useful Edit; see her into LinkedIn and you will Fb.

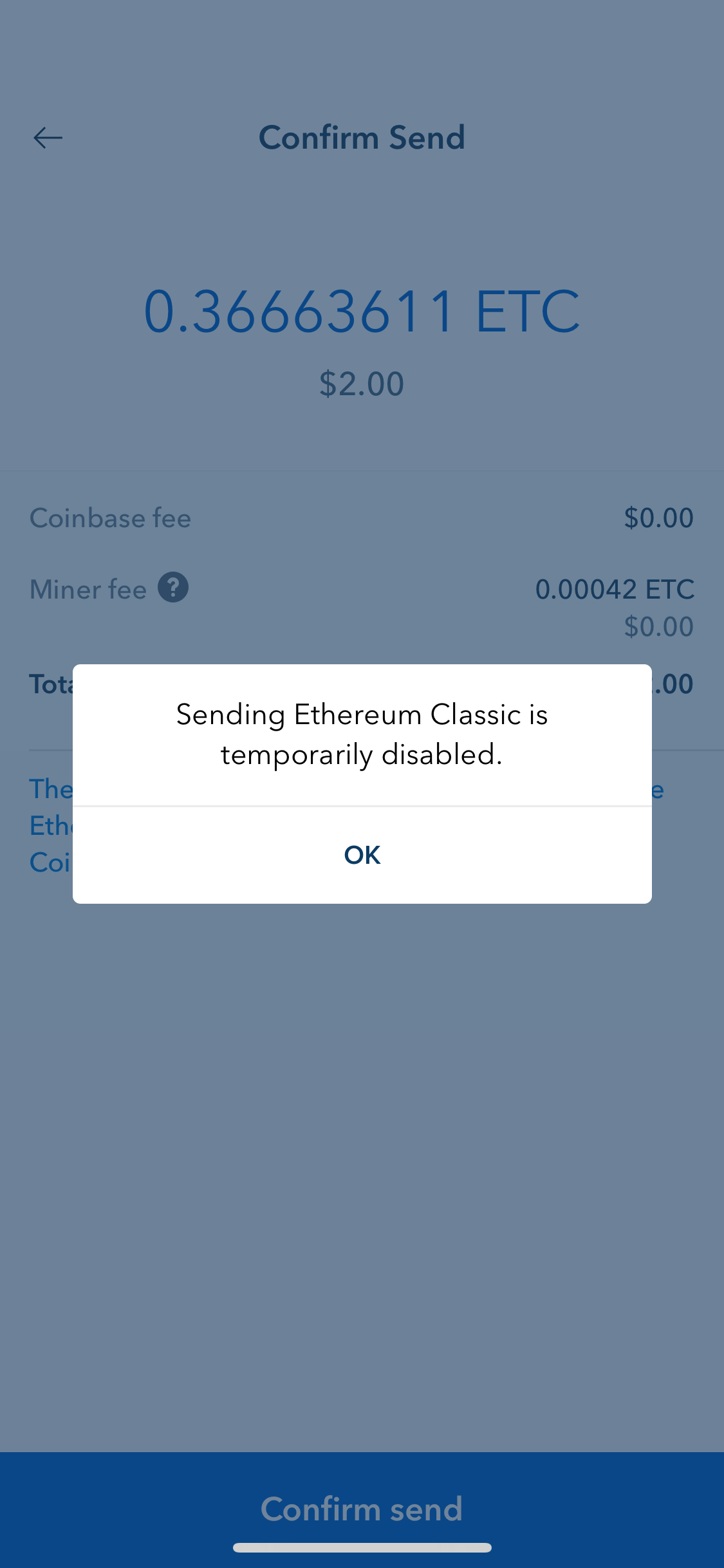

While lowest home loan rates will get incentivize of a lot people so you can reconstitute the funds, the decision to re-finance your home loan will be made according to your own monetary products. So it week’s financial cost should not be the latest choosing reason for although you re-finance.

1. Learn Their Home’s Collateral

The first piece of information that you’ll must review is always to work out how much collateral is during your house. Should your residence is now well worth less than it absolutely was whenever you began your financial-also known as staying in bad guarantee-it does not seem sensible in order to refinance their home loan.

At the end of the next one-fourth out of 2021, consumer count on had increased to their highest level forever of your COVID-19 pandemic. Consequently, predicated on possessions guidance provider CoreLogic, of a lot home owners have observed highest develops within collateral. A recent statement suggests that You.S. home owners which have mortgage loans (which account fully for more or less 63% of all the properties) have observed their collateral raise because of the 29.3% seasons more 12 months (YOY), representing a collaborative security obtain in excess of $2.9 trillion, and an average obtain off $51,five-hundred each borrower, once the second one-fourth from 2020.

Consequently how many homeowners in the negative equity has actually diminished notably during the last 12 months. In the 2nd one-fourth out-of 2020, 1.8 million land-or step three.3% of the many mortgaged attributes-have been for the bad guarantee. So it count diminished because of the 30%, otherwise 520,100000 functions, from the next quarter out of 2021.

Nonetheless, specific belongings have not regained their really worth, and lots of property owners provides low collateral. Refinancing with little to no if any equity is not always you are able to having traditional loan providers. not, some government software are available. How to find out if your qualify for a great kind of system is always to visit a lender and discuss your individual demands. Residents that have no less than 20% equity get an easier go out qualifying getting an alternate mortgage.

2. Discover Your credit score

Loan providers has fasten its requirements having financing approvals lately. Some users is generally surprised you to even with decent borrowing from the bank, they won’t constantly be eligible for a minimal interest levels. Typically, lenders want to see a credit score regarding 760 or even more so you’re able to be eligible for a decreased financial rates of interest. Consumers having straight down scores can still get yet another mortgage, even so they can get pay higher rates of interest or fees.

Trick Takeaways

- Before deciding whether to re-finance the financial, ensure that you enjoys enough house guarantee. At the least 20% security causes it to be easier to qualify for a loan.

- View in order that you may have a credit score out of no less than 760 and you can a financial obligation-to-money (DTI) ratio of thirty-six% or less.

- Explore terminology, interest levels, and you may refinancing will cost you-together with activities and you can whether you’ll have to pay individual home loan insurance rates (PMI)-to decide whether progressing on a loan often suffice your own need.

- Definitely assess the brand new breakeven section and just how refinancing commonly connect with their taxes.

3. Learn The debt-to-Earnings Proportion

For people who currently have a mortgage loan, you may also assume that you can easily score a different one to. But not, lenders haven’t merely raised the club to possess credit scores but and feel more strict in financial trouble-to-income (DTI) percentages. While some items-instance which have a top money, a lengthy and you may steady business record, or large deals-may help you qualify for that loan, loan providers always need to keep the month-to-month homes repayments under an effective restriction regarding twenty eight% of your own gross month-to-month earnings.