How does Education loan Personal debt Apply to To acquire a house?

25 септември, 2024

On this page:

- Just how Student education loans Apply at Bringing a home loan

- Student loan Influence on Credit scores

- Lowering your Student loan Loans

- Other variables getting Acknowledged getting home financing

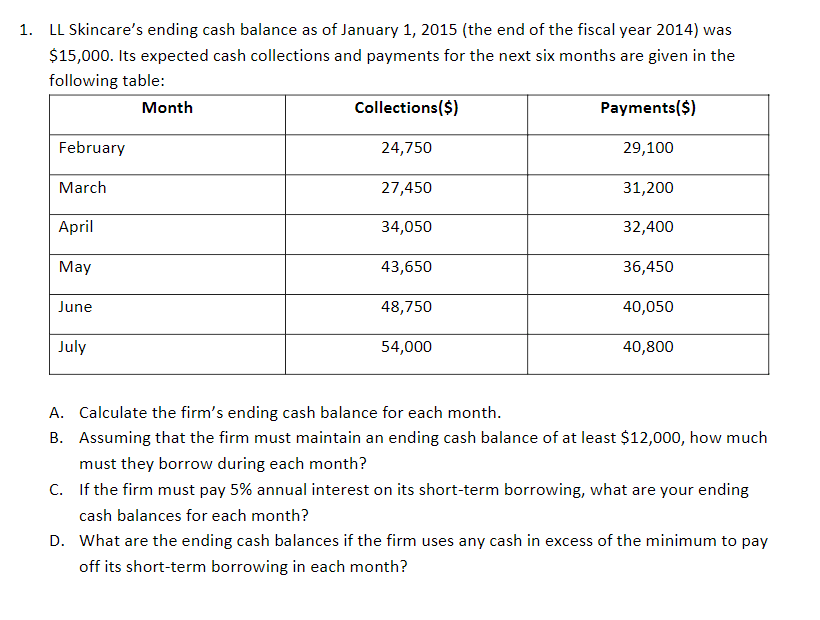

While a recent college or university grad and you will aspire to feel a great citizen in the future, you need to know one to education loan loans make a difference to to find an effective family by simply making it more complicated discover a home loan. Specific 83% off low-residents state education loan financial obligation was blocking them out of to order a good family, according to the Federal Relationship away from Realtors (NAR).

But while education loan payments helps it be more complicated to store for a down payment on the a house, it shouldn’t prevent you from searching for your perfect out of homeownership. The common earliest-day family customer from inside the 2018 had $29,000 when you look at the education loan debt, NAR profile. Read on knowing the way to do education loan obligations nonetheless become approved for a mortgage.

How Figuratively speaking Connect with Taking home financing

Which have a student-based loan, alone, is not a great deal breaker regarding delivering a mortgage. What lenders worry about is when personal debt you have (together with your education loan financial obligation) you’ll apply to your ability to repay the borrowed funds.

After you make an application for a mortgage loan, your debt-to-earnings ratio (DTI) is amongst the activities loan providers consider. DTI compares the quantity of your continual monthly personal debt with your full month-to-month money. In order to calculate your DTI, add up all of your repeating monthly loans (like minimal bank card money, auto loan repayments and you will, definitely, education loan money) and you will divide it by the disgusting month-to-month money (the quantity you get just before taxes or any other withholdings).

Imagine the fresh grad Maria enjoys a monthly income away from $step three,five hundred and a complete recurring monthly debt away from $step 1,two hundred. Their DTI was 34% ($step one,2 hundred split up because of the $3,500). Typically, lenders like to see good DTI off 43% otherwise quicker in advance of giving your for a financial loan, and many loan providers choose an excellent DTI lower than thirty-six%.

What are the results if we include a monthly education loan fee out of $393 to Maria’s financial obligation load? (Here is the average education loan payment, depending on the Government Set-aside.) Today Maria’s repeating month-to-month loans are $step one,593, increasing the girl DTI in order to forty-five%-excessive to track down home financing. Over fifty percent (52%) out-of low-homeowners from the NAR survey state their DTI was remaining him or her away from qualifying having home financing.

Student loan Affect Fico scores

Your credit rating try a variety one lenders use to evaluate debt records to see how creditworthy youre. It’s considering several circumstances, together with how much cash obligations you may have, what type of personal debt you have and you will if or not you have to pay their costs punctually. (If you aren’t yes what your credit score try, get totally free get out-of Experian to ascertain.) Many people have numerous credit ratings, having variations with regards to the design made use of. Loan providers choose which to use when creating the choices, and you can usually play with an excellent FICO Rating ? whenever evaluating home loan apps.

Like all form of loans, education loan debt could affect the fico scores often absolutely otherwise adversely. Lost a student loan fee or and work out a late payment often enjoys a bad effect on the ratings. Later money stick to your credit history to possess seven decades.

And work out student loan money punctually every month, on top of that, might help improve your credit scores. Setting up auto repayments for your college loans can help to make sure you never ever miss a fees, providing you with satisfaction while also possibly improving your borrowing from the bank.

Preserving your borrowing use ratio reduced is an additional way to improve your own fico scores. The borrowing from the bank usage ratio reflects exactly how much of your own available credit you will be indeed having fun with. When you have a whole credit limit out of $9,000 into the about three playing cards and carry an equilibrium off $750 for dominant site each (or $dos,250 overall), your borrowing from the bank utilization price is 25%. A low borrowing use price suggests you will be performing a good work away from handling your debt. Overall, it’s demanded to help keep your borrowing from the bank utilization rate below 31%-the reduced, the higher.