Automated payments away from an excellent Proponent membership are needed for all Family Equity Credit lines

- Expand

- Subscription Eligibility

- Permits & IRAs

- Deals

- Checking

- Borrow

- Auto

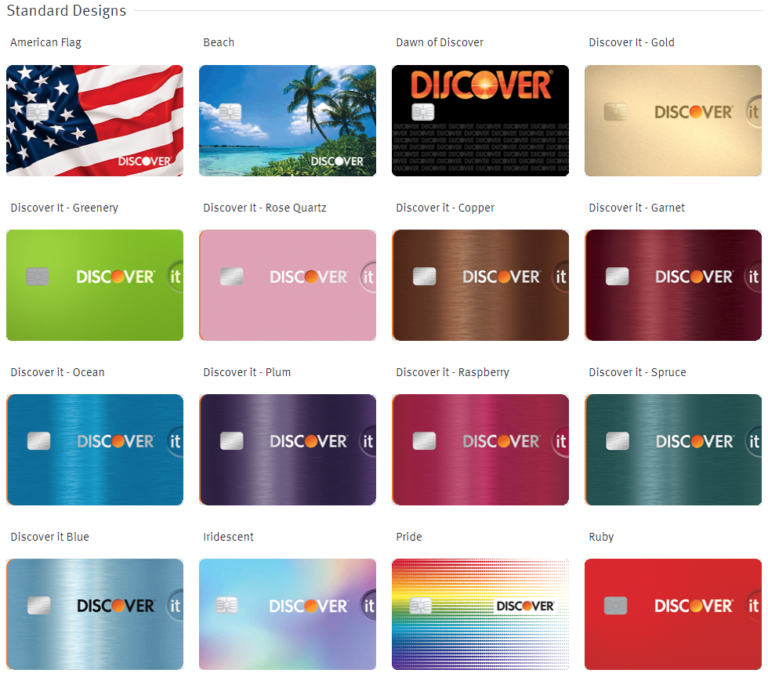

- Bank card

- Personal

What type is right for you?

Using this type of old-fashioned entry to family equity, well-prepared developments could lead to a revenue on your investment and you will higher pleasure from your own assets.

Use your family collateral to combine multiple an excellent balance, letting you reduce your personal debt faster through that month-to-month payment.

For those who have college loans on your own guides, your residence security could help consolidate them having a lower life expectancy speed and a lot more much easier payment.

Your home guarantee you may offer an easily affordable answer to pay money for tall one-date expenses, instance products, chairs, if not a marriage.

Make use of what you individual

Obligations Safeguards facilitate rating relief from financing repayments in the event the a safe lifetime feel abruptly goes wrong with your. It protection you may cancel the loan harmony or money up to the bargain maximums in the event of demise, impairment otherwise unconscious jobless.

Fixed Price Home Guarantee Funds *Apr = Apr. Costs try to possess licensed professionals and they are susceptible to credit recognition. Brand new Apr can vary because of one’s credit history, name of mortgage and value of the property. Mortgage so you’re able to Value (LTV) and/or Shared LTV (CLTV) limitations incorporate. Rates are subject to change without warning.

Offered as much as ninety% CLTV towards the a-1-4 family home, doing 85% CLTV on the condos /townhomes and you will 80% CLTV toward next residential property and you may money attributes. The utmost CLTV for a financial loan level of $three hundred,000 otherwise better is actually 80%. Proponent loan need to be inside the basic or next lien positions. Unavailable getting belongings currently on the market.

Borrower expected to purchase a name insurance policy having mortgage amounts more than $200,000 and really should spend certain costs so you can third parties to start the program. These charges generally overall ranging from $0 and you will $cuatro,000. For individuals who inquire, we’ll offer an itemization of costs you would have to pay in order to third parties. The minimum loan amount try $seven,five-hundred in addition to maximum amount borrowed was $five hundred,000. State certain income tax charge can get apply to closing. Homeowner’s insurance policy is called for; flood insurance policy is requisite in which relevant.

HELOC = Family Collateral Personal line of credit. Apr = Apr. Variable Annual percentage rate (APR) is dependant on The fresh Wall surface Road Log Best Rates typed with the the very last working day of the few days without 0.50% which have a floor regarding 4.00%. Cost can differ according to credit worthiness and cost of one’s home. Mortgage so you can Worthy of (LTV) and/otherwise Joint LTV (CLTV) limitations incorporate. Rates are at the payday loan Repton mercy of transform without notice. Possessions must be an owner-occupied top household.

HELOC financing arrive as much as ninety% CLTV for the a-1-cuatro house or over to help you 85% CLTV into condos/townhomes, from inside the basic or next lien ranks. The utmost CLTV for a financial loan amount of $300,000 otherwise better are 80%. Not available to possess land currently for sale.

Borrower required to pay money for a concept insurance policy to have loan number more $2 hundred,000 and must spend specific costs to help you third parties to open up the plan. These types of charge basically total between $0 and $4,000. For people who query, we’re going to give you a keen itemization of your own fees your will have to spend to businesses. The minimum amount borrowed was $7,500 while the maximum amount borrowed are $five hundred,000. State specific income tax charges will get apply at closing. Homeowner’s insurance policy is required; flooding insurance policy is needed where applicable. Borrower is billed up to $ to own payment reimbursement when it comes to HELOC signed within this 24 months of financing open go out. Consumers must have automatic payment of good Proponent account.

No Comments Yet!

You can be first to comment this post!