Indigenous Us citizens Not be able to Get Borrowing: A near Studies out-of Native Western Home loan Credit From 2018-2021

18 октомври, 2024

Summary

This blog post ‘s the beginning of the a series that looks at the HMDA investigation inside certain a way to center conversations around marginalized organizations that are mainly excluded throughout the federal conversation for the financial credit.

- Native People in america was disproportionately underrepresented in speedycashloan.net/loans/private-student-loans/ financial financing from the one thing out of three. Of 2018 compliment of 2021, merely 0.9% of all the mortgages in the us went to a local Western as they compensate 3% of your own United states populace.

- The tiny sliver from Native Us americans who be able to pick an excellent home will like a manufactured home. Local American mortgage borrowers are more than doubly planning to finance a created house once the most other teams. Tomorrow worth of these house is generally much lower than webpages-dependent housing.

- Mortgage lenders demand large costs towards Indigenous People in america than other teams though they are to shop for a less expensive family. Local Us americans usually shell out way more inside interest levels and you can closure charges getting residential property that have smaller worthy of/guarantee than simply consumers off their racial groups.

Mortgage financing to Native Americans is actually a below-learned topic for some causes. In most Us ericans is half the general population. Mortgages into the Indigenous bookings is unusual, and loan providers for the outlying parts is less inclined to be needed to declaration investigation for the home mortgage programs. Although not, of the targeting ericans are concentrated, established studies possesses insight into the knowledge of accessing borrowing and you will building riches compliment of homeownership.

The present day monetary skills from Indigenous Us citizens try obviously formed of the ages from criminal oppression, broken treaties towards the Us bodies, forced relocation and expropriation. That it ebony background looms on the margins of investigation and therefore employs and also in hence we detail however, that section of the newest wide heritage of an excellent genocide .

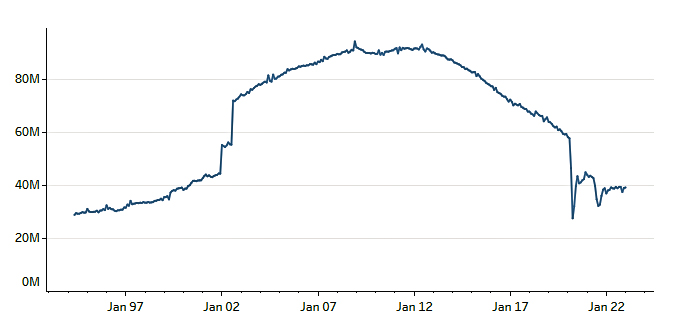

Indigenous People in america however deal with tall barriers in terms of accessing mortgage loans. According to a diagnosis of Home mortgage Revelation Operate (HMDA) studies, simply 0.46% of your own 42 million mortgages built in the united states regarding 2018 in order to 2021 went to an indigenous Western applicant. One of manager-filled mortgages these were only 0.9% of all the individuals. It is lower compared to the dos.9% of your inhabitants that identifies since Local Western by yourself or in combination along with other teams. Thus mortgage financing to help you Local People in the us will have to improve from the the one thing out of half a dozen to achieve parity. By comparison, 14.2% regarding People in america identify while the Black alone or in consolidation with other racing and so they obtained 5.6% of the many mortgage loans away from 2018 so you can 2021, a difference from dos.5.

Where Is actually Local Us citizens Delivering Mortgage loans?

NCRC’s studies including learned that Native American individuals is extremely focused during the particular, brief metro portion you to definitely geographers call key centered analytical parts (CBSAs). The top three CBSAs to have Native American credit are Tahlequah, Oklahoma; Lumberton, North carolina; and Gallup, New Mexico. In most three, more than 30% of consumers have been Indigenous American. Credit to your manufactured home seems to be significantly more concentrated, which have 68.9% out-of are available household consumers within the Gallup pinpointing since the Local American. Into the Gives, The latest Mexico, and you may Lumberton, Vermont, more forty% of are made domestic individuals have been regarding Indigenous American ancestry.

Just what are Indigenous People in the us Capital Employing Mortgage loans?

7.9% of the many Local American homebuyers regarding 2018 to help you 2021 were resource a manufactured domestic. This is more twice compared to every borrowers in the united states (dos.91%).

Light and you can Hispanic homeowners was indeed the following and third probably to get a mortgage to help you funds the purchase out-of a manufactured home, at the 3.26% and you may 3.25% of all the 2018 in order to 2021 household get money.