eight How can i Financing a swimming pool for the Arizona

01 ноември, 2024

Tips Funds a pool during the Washington

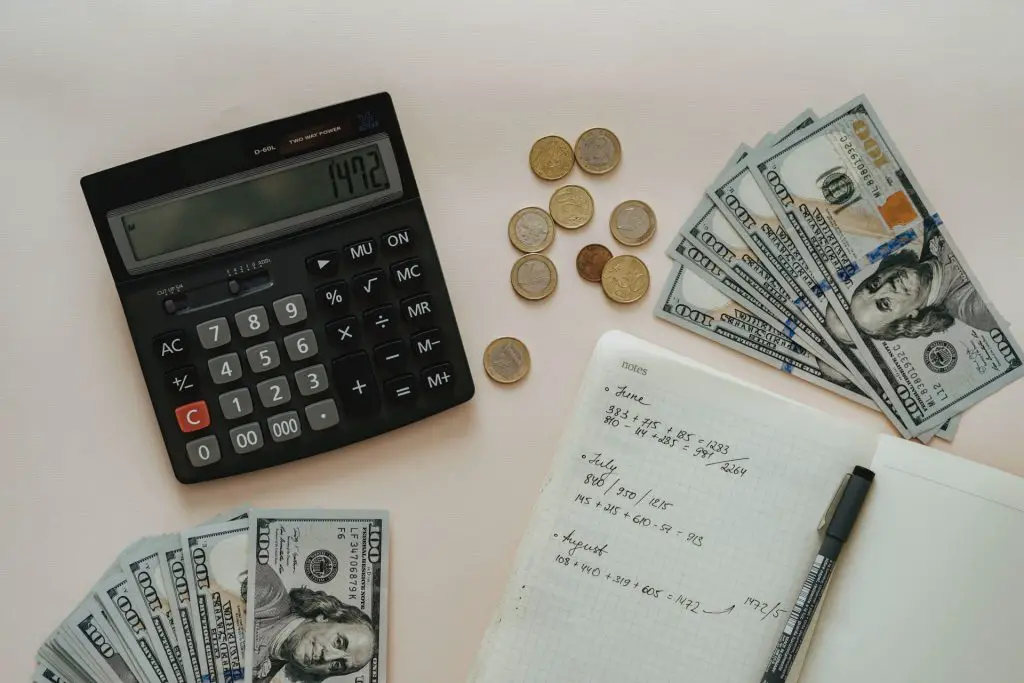

Pools shall be a good inclusion to virtually any home inside Arizona, particularly inside scorching summer season. not, focusing on how to invest in a swimming pool when you look at the Arizona might be a daunting task for many homeowners. Luckily for us, several options are available to money a swimming pool within the Washington.

Here we discuss a few of the popular and more than popular suggests to finance a pool in the Washington so you’re able to begin causing your backyard inground pool eden.

Household Equity Loan

Home collateral funds is loans taken out up against the guarantee in your property. You really have dependent particular security for those who have owned your own domestic for some time. These types of loan enables you to borrow money up against you to guarantee. The attention costs to your household equity money are lower than almost every other financing designs, leading them to an attractive option for investment a keen inground share.

Family Collateral Credit line (HELOC)

A house security (HELOC) personal line of credit is an additional option for resource a share in the Arizona. A beneficial HELOC is somewhat the same as property security financing inside the guarantee in your home secures they.

Although not, good HELOC are good revolving personal line of credit, you is borrow and pay off currency as needed. Simultaneously, the interest costs into the a good HELOC are typically variable, which means that they could change over the years.

Personal loan

An unsecured loan try a consumer loan used for individuals intentions, together with resource a pool. one can see a personal loan from financial institutions, borrowing unions, and online loan providers.

Personal bank loan rates are usually greater than household security finance otherwise HELOCs, however they are however below credit card cost. Ergo, signature loans can be recommended just in case you perform n’t have enough security in their home in order to qualify for good household collateral loan or HELOC.

Playing cards

As many folks enjoys handmade cards, they often times are a convenient cure for fund a swim pond however they are in addition to the most costly choice. Mastercard interest rates are generally greater than many other products regarding finance, and adds up quickly if you’re unable to pay-off the bill in full every month.

not, imagine you have a charge card which have a beneficial 0% introductory Apr promote. Therefore, you can loans their pool without paying attention having an effective certain period.

Pond Capital Organizations

Numerous pond resource businesses focus on providing resource getting swimming pools. These companies often spouse that have pool developers and provide aggressive pricing and terminology. Pool financing people usually render signature loans, which means your household does not secure them.

The interest costs during these financing are going to be more than house collateral loans or HELOCs, nonetheless is significantly more versatile out-of cost solutions.

Whenever employing a highly credible pond creator in Arizona, financing owing to all of them sufficient reason for its mate normally ‘s the best choice and may always be considered.

Cash-away Re-finance

An earnings-away re-finance is another choice for financial support a share in the Arizona. This requires refinancing your mortgage and you will raising the monies you already owe by using aside https://paydayloanalabama.com/saks/ a lot more.

The difference between their old financial plus the the brand new home loan is actually offered to your inside dollars, which you can use to invest in their pool. Cash-away refinancing shall be an effective solution if you have oriented right up excessively household security and certainly will obtain a great down interest into the the newest mortgage.

FHA 203(k) Financing

FHA 203(k) fund are used to fund home improvements, and additionally pool installations. This new Federal Property Management guarantees the newest FHA 203(k) mortgage. Its available for residents who would like to boost their belongings however, you want extra cash to fund all of them upfront. The eye prices towards the FHA 203(k) fund are usually lower than other sorts of money, but strict guidance and needs should be found to qualify.

Ready to Find out about the best A way to Funds a Pool?

On Zero Restrict Pools & Health spas for the Washington, we’re here to help you get started together with your garden pool heaven. However,, before we manage, we understand resource is usually challenging and a problem many home owners don’t want to handle.

Therefore, why don’t we get this to as easy as possible for your requirements. Contact us so we can also be explore your own funding possibilities. We are particular we could guide you from the most practical method. And you will after ward, while completely pleased with your funds azing pond simply to you off very first to luxurious. There aren’t any restrictions on No Limitation Pools and Spas.