3 Mortgage Progress Solutions to Make your Customers Credit Portfolio

07 ноември, 2024

On the fluctuation of lending areas, financial institutions must be happy to boost buyers retention, and acquire new customers, and you will perform exposure building a lending collection in almost any situation. Specifically as housing market flights towards the tumultuous seas, it is essential you diversify financing progress tips across numerous channels.

From the following posts, i talk about about three mortgage growth solutions to build your lending profile, providing their business grow and you will thrive, regardless if avenues try unsure.

#step one. Family Security Financing

The newest Financial Brand, a resource for financial institutions, stresses the necessity of taking advantage of home collateral financing: If the establishment actually definitely marketing household equity loans and you will contours off borrowing from the bank, you are quitting potential business so you’re able to a small number of monsters.

Domestic collateral financing can be utilized since the a method to succeed homeowners to help you utilize their residence collateral at once whenever a property beliefs always go. Hence, even when the housing market really does begin to slow and you will people is actually getting set, family equity credit now offers an additional source of income for financing institutions.

Sadly, people having generous family collateral often have absolutely nothing expertise in exactly how so you can efficiently access otherwise comprehend the great things about making use of it. However, this enables lenders the ability to generate its lending portfolio if you find yourself enabling property owners browse the realm of house guarantee.

Your own financial institution can be pick consumers that have a great equity and instruct all of them regarding the likelihood of good HELOC or house security financing. If caused and you can educated by a reliable specialist, significantly more homeowners could possibly get look at the solutions and you can benefits of increasing and you may using their family security.

Why You will Anyone Go after a property Guarantee Financing?

That have today realized the purpose and you may great things about family equity loans, homeowners often find the outlook off leverage domestic security tempting, specially when compared to almost every other prominent ways of funding high sums, such as for instance handmade cards. Home collateral mortgage rates are far lower solution alternatives.

Household security money promote high liberty in terms of how you to definitely acquires the loan. Like, property owners can also be look for a second mortgage, property collateral personal line of credit (HELOC), or cash-aside refinance.

- Generally, property owners exactly who favor the second home loan will use the complete share in order to consolidate loans, pay money for unforeseen medical expenditures, fund relationship expenditures, otherwise loans yet another urgent need.

- As an alternative, the brand new HELOC could be picked because of the residents stepping into renovations, carrying out a corporate, or seeking an attempt that would require cash over the years.

- Cash-away refinancing brings timely bucks, mentioned by the enhanced domestic worth. Property owners can use which cash to help you refund bank card or university financial obligation, better position by themselves for most readily useful rates and you will re-finance opportunities.

Predicated on TransUnion, an estimated ten million People in america manage go after HELOCs between 2018 and you can 2022 in addition to development is continually up. Hence, lending establishments will be proactively guide people to choose another mortgage, HELOC, or cash-away refinancing, depending on how the newest homeowner would like to use that money.

#2. Home improvement Financing

Such household security lending, unsecured do it yourself financing keeps increasingly grown up within the dominance, particularly in the past seasons. The prospect off enhancing the selling value of one’s domestic or improving well being at home is of interest however, domestic renovation is expensive.

Extremely somebody do not have the money on hand to pay for such expenses, so that they means creditors to possess lending products. As a result $255 payday loans online same day New York, which financing growth strategy is an excellent possible opportunity to arrive at broader segments. Hence, along with your varied financing profile, acquiring the expertise so you can strongly recommend and offer a property guarantee financing otherwise unsecured do it yourself financing can give chance for development in diverse financial points.

#step three. Small Installment Loan (BNPL)

Brief installment loans try a separate progress approach with rewarding possibility of building the financing collection, particularly for payees regarding more youthful generations.

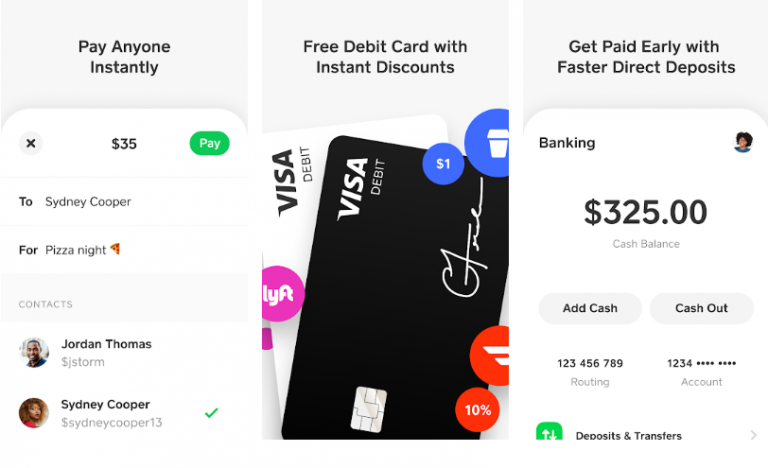

Consumers are trying to quick, easy a means to buy things. Especially for millennials and you will people in Gen Z generations, the latest pick-now-pay-later (BNPL) mindset is an effective motivator, inspired simply because of the COVID-determined e commerce hunting.

Many area-of-profit loan tech, instance Afterpay, were put up and you may deployed in reaction. The fresh BNPL pattern lies in consumers’ subscription mindset which is unlikely to fall off soon. A survey by the Ascent, a beneficial Motley Deceive tool, discovered that this new BNPL pattern has increased from the nearly 50% in a single year, plus the growth rate is quickly persisted up.

Finance companies shall be conscious of subsequent individual choices alter plus the interest and you will need for a seamless, integrated customer feel so you can each other users and resellers. Plus, financial institutions is actually being attentive to resellers showing a willingness, at the very least near-name, to blow a charge in order to BNPLs just after ages regarding pressuring banking companies and you will systems to minimize costs.

This market provides enormous potential and financial institutions is to take note of that it development as it can certainly establish whole future generations.

Centre Financial Services: A strategic Financial support

At Center Monetary Services, we are educated insurance policies specialists whom attention entirely on decreasing risk and you will increasing profitability to own loan providers across the nation. Recognized for the ethics, credibility, and expertise, our customers are the best insurers and you may services in the the company.

Imaginative finance companies and you will borrowing from the bank unions will be selecting the fresh revenue avenues out of products they are not providing now. This will wanted standard bank management to think additional its old-fashioned boundary contours. Just how often your financial business become more associated since consumers’ criterion progress and alter, and you may the fresh development appear?

To learn more about our functions otherwise all of our impact, contact all of us! You can started to you through all of our contact form below. A professional will promptly reach out to pay attention, reply to your inquiries, and provide pointers away from the imaginative insurance policies products and services.