Unique factors to have customers who are not hitched

08 ноември, 2024

Might you buy a home together during the Charlotte whenever you are not married? Yes, you could – but you can find essential factors to take into account very first.

Regardless if you are seeking reduce houses, investing a home , or just not interested in marriage, buying property with some one you are not married in order to was a large choice. However, so long as you simply take precautions, you and your partner can enjoy the many benefits of combined homeownership.

Right here, we shall go over the basic strategies to buying a house that have anybody you are not married so you’re able to, precisely what the related mortgage guidelines are in Vermont, and you will what dangers you ought to watch out for.

Ideas on how to prepare for the acquisition

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-overdraft-and-cash-credit-Final-8e1e4594a99342748fc565d7c5dd66d3.jpg)

Before you agree to it huge financial decision, take a moment to learn the benefits and you will downsides off a beneficial combined home loan software.

Coborrowers and you can joint mortgage applications

Individuals tend to purchase a home on their own otherwise and their companion. But if you are interested having a buddy, a sis, otherwise an effective boyfriend or girlfriend, you might.

Pros : Trying to get a joint home loan setting you may also use your combined profits and you may possessions so you’re able to be eligible for a more impressive financing . You are able to for every single be a co-debtor, and you may per get on the fresh new title.

Disadvantages : That have a shared financial, it is possible to each other getting accountable for your debt, even though among you will lose your job. And additionally, the lending company can look during the existing obligations and you may credit history for both people, so any negative records can damage the job.

Co-signing

An alternative choice is actually for someone to-be an important debtor, into almost every other since co-signer. In this case, the lender would measure the mortgage according to the direct borrower’s money, credit rating, personal debt, or any other issues. With a cosigner may help fortify the financial application otherwise safer a rate of interest in the event that its credit score is right. You should keep in mind that the following debtor might be towards the the borrowed funds but wouldn’t be with the term. In this case they’d still be responsible for your debt if for example the top borrower defaults.

Benefits : The advantages of with one individual feel a beneficial cosigner would be the fact it helps so you’re able to balance the other borrower’s credit rating.

Disadvantages : On the other hand, in case the bank is wanting at one to earnings in place of each other revenue together, you might not qualify for because the large a mortgage since you want. The fresh cosigner is even at greater risk, because they are guilty of your debt devoid of the name into the the latest title.

You will want to one another discuss earnings, funds, and you may value. You will additionally need to parece goes for the label, for the reason that it impacts the mortgage you get.

Economic

Maried people usually have shared finances – that is unlikely if you are not hitched. Therefore, you may not be aware of the complete the total amount of one’s partner’s incomes and you can costs, instance. Just how much is each of you be able to subscribe the new home loan? That might affect if you choose to opt for a joint financial or otherwise not. When your earnings try significantly more, one to instability make a difference to your capability to settle the borrowed funds will be things happen to the other person.

Furthermore a smart idea to developed a spending budget and you may try for the fresh commission terms. That will actually make this new percentage? Do you wade , otherwise per spend an amount of homeloan payment according to your income? What the results are if the fee try later? And you can imagine if we should promote or re-finance , for folks who separation, or you wed? Understanding ahead of time how the home loan procedure works can assist your lay standards and produce an agenda for the future.

Legal

Will one another labels continue the fresh new name? If you are each other likely to be living together and you will sharing obligation into maintenance, it makes sense to provide both labels to your label. In courtroom terms, this would be mutual tenancy. You for each and every has actually rights, nevertheless for every single likewise have judge responsibilities. This configurations also offers into property to visit brand new other individual if a person people passes away.

Another option is called tenancy in accordance. Below so it plan, you per own a portion of the home, but if certainly one of you becomes deceased, that display doesn’t solution to another individual. As an alternative, you to share would go to brand new estate.

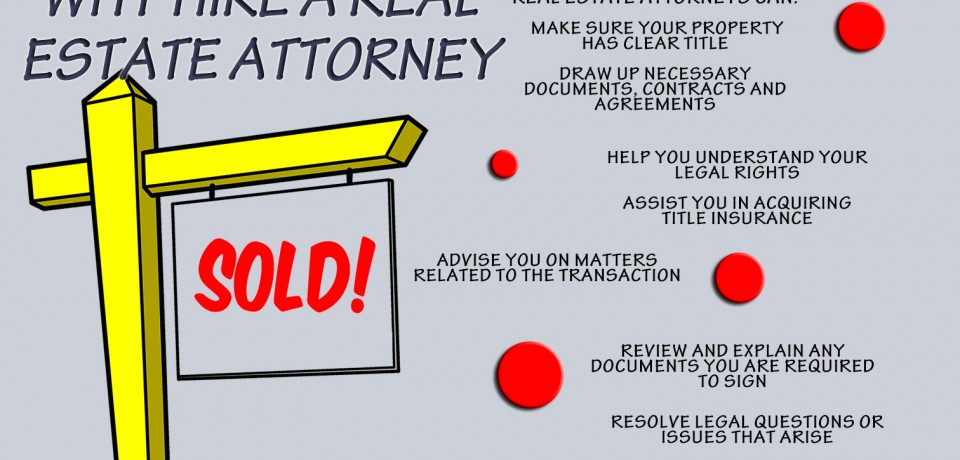

It’s best for a lawyer make it easier to write your ownership contract so you for each and every discover the rights and you will obligations.

Virtual assistant finance and you may FHA financing to own unmarried buyers

If you are looking to possess a mortgage system, such an experts mortgage or Government Housing Management (FHA) mortgage, the guidelines try a tiny some other to possess single partners compared to partnered of these.

Such, VA-recognized mortgage brokers is actually to own You.S. veterans (as well as their spouses). You can purchase a combined Virtual assistant financing that have a good coborrower you will be maybe not elizabeth since it do if perhaps you were hitched. The new Va-backed make certain of your the borrowed funds just pertains to the fresh veteran’s part of the household, maybe not the brand new non-veteran’s.

Your financial makes it possible to decide how the details of certain finances squeeze into one of those mortgage software.

Deciding on the best home loan company

Whatever the your role, finding the best mortgage lender are a payday loans Gilbertown very important section of the procedure. Friendly, verbal, and educated home loan experts should be able to help you navigate the procedure of purchasing property with someone you are not married so you’re able to. They will certainly always are-told and prepared concerning the process, and they’ll render qualified advice customized into the state.

During the Fairway Home loan of your own Carolinas, i place anybody earliest. E mail us for additional info on your own financial possibilities, and you may let’s help you plus co-visitors get right to the closing dining table.