Differences when considering Fannie mae and you may Freddie Mac computer

11 ноември, 2024

Even in the event Fannie mae and you can Freddie Mac have similar purposes and operations, you will find some differences between them. Listed below are some of them:

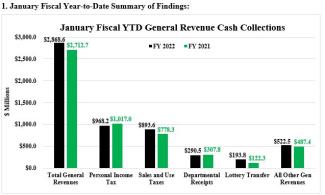

Just how do Federal national mortgage association and you can Freddie Mac computer Affect Residents?

Federal national mortgage association and you may Freddie Mac computer apply to home owners because of the encouraging very conventional U.S. mortgages, reducing risk to possess loan providers and you will dealers, and you can and therefore to make mortgage loans inexpensive having borrowers and you may create-be home owners. Such businesses have the effect of the available choices of 29-season fixed-rate funds from the You.S., that make right up 70% of the marketshare . Loan providers benefit from faster chance, hence prompts even more lending, when you are investors find mortgages https://www.paydayloansconnecticut.com/plattsville more attractive due to the protected characteristics of these loans.

Fannie mae and you will Freddie Mac’s exposure on the market assists balance out it and will be offering necessary liquidity. The particular criteria and you will qualification requirements make certain that loans conference its requirements discovered pledges, next supporting the home loan ericans wouldn’t be in a position to become people as opposed to Federal national mortgage association and Freddie Mac computer.

The Role off Fannie mae and you will Freddie Mac computer in the Economic crisis

Federal national mortgage association and Freddie Mac enjoys starred important jobs into the present financial crises, like the 2008 economic crisis while the COVID-19 pandemic.

2008 Financial crisis

Fannie mae and Freddie Mac’s character about 2008 economic crisis was advanced, meaning that i won’t mention it entirely here. Simply speaking, 2008 noticed the federal government following through to reinforce the brand new You.S. benefit and housing marketplace from the and when conservatorship out of Federal national mortgage association and you may Freddie Mac.

Aspiring to balance the marketplace and you will heal Federal national mortgage association and Freddie Mac to help you a great voice and solvent updates , government entities intervened to get both businesses in the conservatorships, where it are nevertheless today. Signed towards legislation from the President George W. Plant inside , The new Casing and you will Economic Data recovery Act out of 2008 (HERA) anticipate the brand new FHFA the legal right to set Federal national mortgage association and you can Freddie Mac when you look at the conservatorship.

As the conservator, the brand new FHFA takes care of the newest enterprises as well as their respective chatrooms regarding directors. New Agency and you may administrators daily demand in order for brand new operations and you will choices each and every company was recognized. On top of that, new people try served economically from the U.S. Agency of the Treasury to ensure for each and every remains solvent and can also be continue steadily to see their role because the stabilizers of your home loan industry.

COVID-19 Pandemic

Inside the COVID-19 pandemic, employment loss or any other things added of several home owners in order to not be able to shell out its housing will cost you. In reaction, the federal government enacted the newest Coronavirus Help, Save, and you will Economic Cover Act, or CARES Work.

The fresh new CARES Work provided many benefits so you’re able to Americans within the pandemic, including monetary assistance in the way of stimuli inspections, eviction/property foreclosure moratoriums, and you may mortgage recovery for these having mortgage loans backed by Federal national mortgage association or Freddie Mac computer. This contributed to better independence and you may less losses getting individual home owners influenced by the new pandemic.

Financing Qualification

When you’re trying a traditional mortgage supported by Fannie mae or Freddie Mac computer, you must see certain eligibility criteria having acceptance. There is certainly a reason as to the reasons too many People in america features mortgages backed by these two firms: Fannie mae and you can Freddie Mac-recognized finance offer apparently available terms making sure financing high quality and promising them to generate loan providers much warmer using up risk during the financing for you.

Federal national mortgage association and you can Freddie Mac computer enjoys their unique individual criteria to have mortgage eligibility, since the usually their financial. As a whole, however, borrowers will need reasonable obligations, the very least credit history to 620-660, and you may an acceptable downpayment. They should also meet up with the conforming financing restriction really worth toward season.

Below are a few of your differences when considering mortgage qualifications conditions getting Federal national mortgage association and you will Freddie Mac since 2024.

To learn about exactly how these two corporations are controlled, you can view the us government serves one to depending them: The brand new Government Nation Mortgage Relationship Rent Operate in addition to Federal Family Financing Financial Company Operate .