Understand the difference in a beneficial pre-property foreclosure house and you may a preliminary marketing

18 ноември, 2024

A great pre-foreclosure happens of course, if a resident defaults to their mortgage money, getting their home in jeopardy off foreclosure. As an alternative, the debtor chooses to pay back the new a fantastic harmony otherwise offer our house during that date. Pre-property foreclosure home was common certainly a house speculators for two objectives. One is there is absolutely no advertising having Pre-foreclosures home. Very there was limited competition. Secondly, pre-property foreclosure are superb a residential property financial investments, since these homes can also be listing obtainable not as much as market price. Most household buyers looking to invest in pre-foreclosures, in addition, is unsure of how-to buy good pre-foreclosure.

If you are considering purchasing a house and want to search on the internet only to see solutions, you’ve reached the right spot. Both you discover property marked once the a good pre-foreclosure while you are beginning to be aware of the urban area – aesthetically inspecting characteristics that seem to fulfill your requirements and you can matches your general finances, challenge to feel happy about the candidates.

Understand the definition of pre-foreclosures land

Once the statement ways, our house within the concern is towards brink away from property foreclosure. The fresh new renter has fallen unpaid to their mortgage costs. While they have a chance to maintain in advance of the lending company confiscates our house. He’s in fact obtained a proper standard notification. Pre-property foreclosure ‘s the early stage throughout the foreclosures procedures. Although not, it differs from destination to place. New legal proceedings typically start when a borrower misses about three successive month-to-month money. The bank will send a great pre-foreclosures report. They means that our house is just about to foreclose instantaneously. The citizen get to dos-ninety days to reply immediately after receiving the newest observe off standard within the a make an effort to avoid the property foreclosure continuing. Having said that, unlike property foreclosure, the owner can be liquidate the property resource themselves. It listings a house on the market at the a less expensive speed owed towards the seller’s enormous motivation.

Pinpointing leads directly in pre-property foreclosure house

When choosing a good pre-personal bankruptcy, recognizing exactly how and when locate pre-foreclosure leads is extremely important. Employing an expert a residential property broker ‘s the greatest approach for choosing pre-foreclosed home or a beneficial pre-foreclosure bidding. Joined agents enjoys accessibility to the many Property Properties, which contains pointers having pre-foreclosure land. These professionals can typically compensate for the fresh revenues of one’s offer. You are able to to locate from-business house thru local in public offered information, click, real estate agent dealers’ pointers, otherwise regional lawyers’ reviews.

Property into the pre-property foreclosure and you will a short income lot may have some parallels through to very first look, but they are significantly collection of. A short deals happens when a debtor owes a lot more towards the their residence than valued. It is also classified because the under water.’ Quick income property entail transactions into the home loan company to record a house for sale during the below any type of normally very own to help you avoid so it shortfall. The property owner usually can walk away ever since of termination without having any almost every other liabilities. When you are houses and you may rentals for the pre-property foreclosure generally get sufficient really worth to include the newest the financial.

Look a creditor

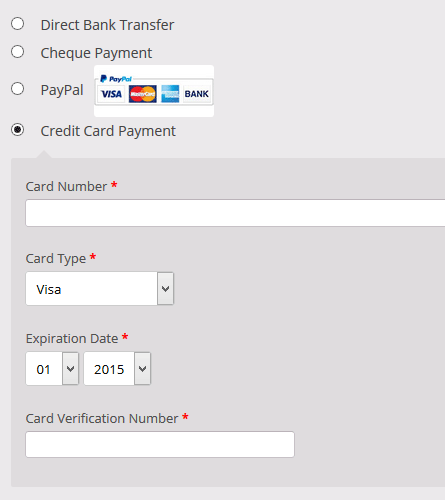

It’s also possible to require a pre-approval document off a collector when purchasing a home by way of a pre-foreclosures family. That it file usually suggest how much you could potentially provide. Anybody can are experts in possessions opportunities that will be using your finances. A pre-recognition declaration as well as implies that you are an efficient and you may legitimate bidder towards citizen. Yet not, extremely brokers tend to decline to work with you or even have this declaration. You might receive a research of pre-acceptance. You may need the following records to get the acceptance page:

- Your account comments

- Paystubs from the last couple of days

- Summary of borrowing

- Statistics out of taxation statements

- Your name research such as your passport or a driving licenses

Distribution a proposal:

You could make a deal when you get a pre-recognition declaration on your own desired pre-foreclosure property. New payment phase to the domestic demands 1-8 weeks. Whenever you are dealing with a difficult mortgage borrower or providing capital, this time figure is also much faster. It is advisable to hire a bona fide property agent when you are bidding. Since they’re usually alert to the fresh procedures, your broker usually handle your case in dealings when you are talking about the fresh new homeowner or collector. You can then transmit the sales agreement towards bank to help you begin evaluating the loan in the event your proprietor becomes their proposition.

Payment is the final stage in the pre-property foreclosure purchase process. Settlement ‘s the past stage of buying an effective pre-closing property. Inside phase, the fresh new no credit check payday loans East Pleasant View CO label to your possessions is become the latest succeeding proprietor’s label. Brand new import procedure normally takes two hours. The closing Bargain happens in a title enterprise. Down costs, plus loan charge, accountability insurance coverage, moving taxation, and a house fees, was upcoming owed. These expenditures is also approximate 2% to 5% of to shop for price. The brand new money house is perhaps all your own when the closing stage for the buying good pre-foreclosures normally done.

Ultimately, once you decide on the stages in to order a pre-foreclosures home available. Then make sure that the fresh new expenses will change towards possession. Get in touch with good locksmith and also have brand new locks for everyone of one’s doors in your home. Substitution old tresses allows you to stop any potential accident. If for example the assets means refurbishment, get to works straight quickly. Number our home offered otherwise lease if it is inside very good shape. Guarantee this informative guide allows you to into the to find a foreclosures house with ease.