A bankruptcy can be bump doing two hundred facts away from your own credit rating

13 ноември, 2024

The interest pricing for a mortgage after personal bankruptcy vary, according to the loan and also the borrower’s credit rating.

Rates go up and down, based financial issues. For instance, during the 2020 and 2021, the newest You.S. Federal Set aside leftover interest levels historically low. While you are pricing vary, the fresh new gap between the rates to have a debtor with a high credit history and another that have the lowest credit history remains regarding an identical.

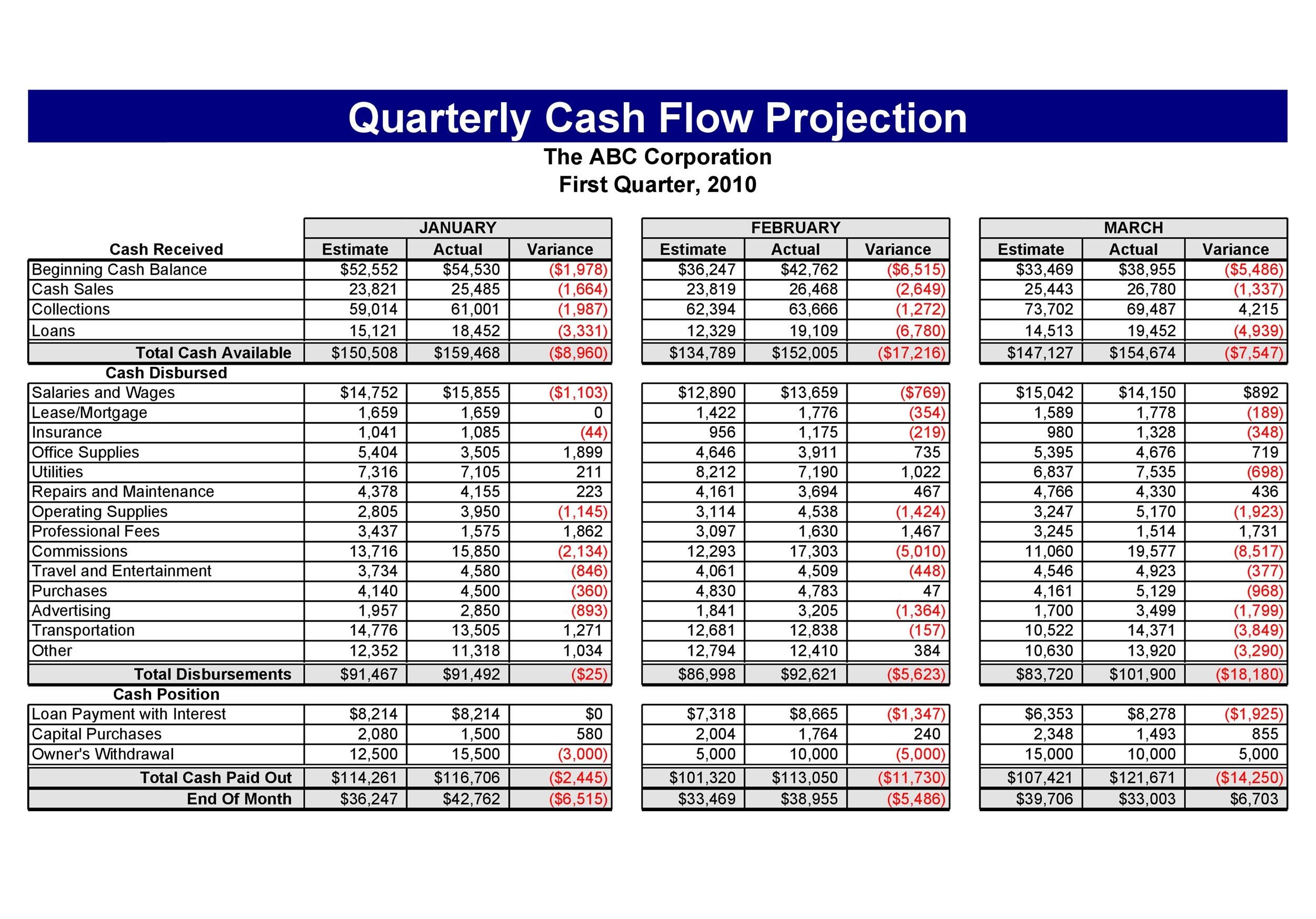

This chart, demonstrating costs regarding 2021, measures up rates for several form of funds as well as how http://www.cashadvanceamerica.net/payday-loans-vt/ they differ which have fico scores:

What are FHA Fund?

FHA funds was mortgage loans supported by new Government Casing Expert, available for people that possess trouble taking a normal financing due to a dismal credit record or earnings. FHA finance has smoother credit criteria minimizing down repayments.

Once the You.S. bodies backs new loans, lending establishments much more happy to offer them to applicants with less than perfect credit ratings, while the lower your credit score, the fresh new much harder it could be to find a loan provider.

A debtor with a FICO score off 580 can also be qualify for an FHA financial that have a down payment off step 3.5% and someone having good ten% down payment can be be considered with a four hundred get. The lower the latest rating, the better the rate plus the more complicated it could be locate a lender. If you are applying with a credit history below 600 can be done, below 2% from FHA financial consumers had a credit score you to low early from inside the 2021.

Section thirteen – A couple of years if the package money were made timely and you can brand new trustee of case of bankruptcy gets a fine.

What exactly are Conventional Finance?

They may not be secured because of the regulators, nonetheless they normally have a knowledgeable interest rates and you will words, which means that down monthly payments. Typically the most popular kind of old-fashioned home loan is 30-12 months repaired-rate, and this taken into account 79% out-of mortgage loans between 2019 and 2021, based on Freeze Mortgage Tech.

Antique fund want a credit score regarding 620 or more. The higher the new rating, the better this new terms. One of the biggest masters would be the fact a down-payment regarding 20% function you don’t have to spend individual home loan insurance rates, which can include many in order to a mortgage.

Even though you do not set-out 20% on closure, because the equity in your house has reached 20%, the new PMI try fell. That have an FHA financing, it never drops, along with to spend a-one-go out up-top superior of just one.75% of legs level of the mortgage.

- Chapter 7 Couple of years once launch time

- Section 13 24 months. Whether your case is dismissed, and that happens when anyone declaring personal bankruptcy doesn’t proceed with the plan, its four years.

Just what are Va Fund?

The Virtual assistant loan system, given because of the You.S. Service out-of Experts Issues, even offers low-costs fund so you can experts and you may productive army professionals. Qualified consumers commonly needed to create off payments, a number of the settlement costs are forgiven and you may individuals don’t possess to blow home loan insurance rates.

There are many standards when you have gone through a bankruptcy when they need a great Virtual assistant loan.

Chapter 7

- Zero later repayments because bankruptcy proceeding submitting;

- Zero derogatory credit (collections) due to the fact personal bankruptcy;

- At least median credit score out-of 530-640 (centered on where debtor existence);

- Two-year wishing several months shortly after release.

Chapter thirteen

- At least one year waiting from bankruptcy initiation date;

- A reasonable show of the case of bankruptcy cost plan;

- No later money following the go out of 341 (appointment away from financial institutions and bankruptcy trustee);