Brokers gamble secret part when you look at the the fresh Athena fund

11 януари, 2025

It is a sign of exactly how definitely Athena Home loans beliefs the third-team channel that it co-tailored the the fresh mortgage products in collaboration with home loans.

Athena circulated its the package out of Tailored lending options, including Mind-Operating Lite Doc and 80 85% Zero LMI, towards the Friday.

The fresh new non-financial lender told you they would deliver unequaled representative and you will avoid customers experience, scaled that have devoted BDM solutions and you can borrowing teams to own timely workshopping.

Ahena federal BDM specialized facts Stephane Feuillye (pictured more than kept) said the organization recognised the newest important need for brokers in the financial sector.

Brokers show an extremely similar goal to Athena for the reason that they are present to offer the greatest outcome and you will sense having customers, Feuillye told you. It aligns so directly which have Athena’s objective adjust mortgage brokers for good. Form brokers up for achievement try ultimately crucial that you Athena.

Feuillye said it was why Athena was obsessed with deep partnerships where it co-created the product and you may solution enjoy it needed, and people who their people called for.

We co-tailored our Designed device feel privately having agents to send for the the latest underserved requires of the expert debtor cohort, said Athena Ceo and co-originator Nathan Walsh (pictured more than best).

Designed financing having borrowers

In addition to the Mind-Operating Lite Doctor and you may 80% – 85% No LMI, which happen to be available now, Athena is additionally initiating a non-Absolute People and you may Trusts equipment inside the September.

These items was made available to agents by way of several aggregators the fresh white label Financial Possibilities Versatility Tailored variety, in order to LMG because of Athena Tailored.

Feuillye said Care about-Operating Lite Doc was created for consumers into the a robust monetary updates but just who expected certain flexibility within records they had to add.

Such, rooms its tax get back is simply not lined up to once they need to make a move ahead housing fund, he said.

All of our policies promote versatile income verification, and you can our wide range of products also means they won’t need to see you to bank to have a beneficial lite doc device immediately after which wade somewhere additional and you will look at the whole process again just after he could be happy to proceed to full doc.

A unique key ability informed of the broker co-build are Tailored’s customised rates. Feuillye said that it recognised that not the entrepreneurs were the brand new same. We should be pretty fulfilling people due to their organization possibilities that have an increase that shows their disease.

Tailored’s 80 85% No LMI solution supported a good consumers just who will had bucks tied up in other potential and you will didn’t need certainly to https://paydayloancolorado.net/portland/ delay entering the market otherwise desired most independency with no cost of LMI.

Feuillye told you when introduced from inside the September, the non-change trusts and you may people tool would provide an answer having people and you can worry about-working borrowers wanting an advanced solution to structure their house investments.

A full package now offers all of our rich provides: breaks, offsets, multi-security and you may a rich digital expertise in the fresh mobile app. This will be backed by great costs and cost, together with best in market SLAs and you may representative service, he said.

Agent opinions helped Athena

Walsh told you an essential part out of Athena’s proposal plus one off the new secrets to new success it actually was sense having its aggregator lovers try a persistent method to experiencing broker opinions.

Providing one to notion what exactly is high, where is there work to create, where certainly are the possibilities to take on the way we is going to do one thing differently, told you Walsh.

There is an enthusiastic underserved sector of investors and you will care about-employed individuals who want significantly more flexibility with regards to their financials, but also need a fully appeared equipment.

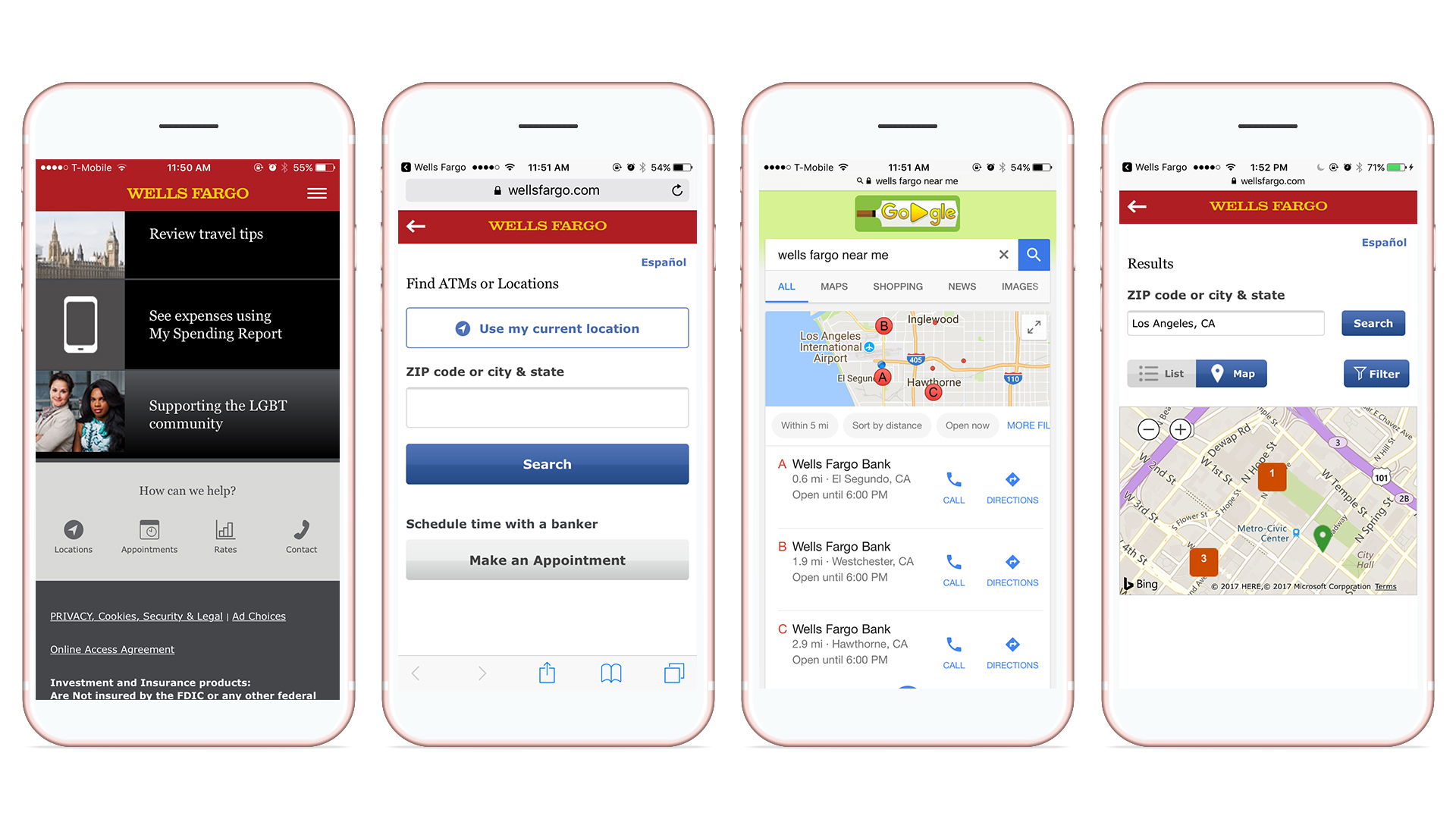

When you look at extremely designed activities to be had, he’s very earliest, while these items can give breaks, offsets, multi-equity and you may a refreshing digital experience with the fresh new cellular app.

Raise to own BDM and you will borrowing groups

Athena has also reinforced its BDM and borrowing groups having the fresh employs. Walsh told you it had extra reasonable expertise in advanced lending situations.

Our company is dedicated to maintaining our very own reputation of entry to, reliability and you may price around the these two teams. The initial measure in these teams would-be tracked aligned in order to regularity and we will still generate as required.

I have already been supporting brokers to grow their people to have most of my 20+ season industry in home money, Feuillye told you. Having the ability to do that from the Athena … is one thing I am truly thinking about.

Athena towards growth trajectory

The new non-financial fintech is actually oriented during the because of the Walsh and you may co-maker Michael Starkey which have a goal adjust mortgage brokers for good.

1st, our attention is on prime holder occupier and you will trader locations; in accordance with people products firmly in market, it was time to resolve the following possibility, Walsh told you. I consulted which have brokers extensively to size those people locations towards the best you need, and you will recognized Tailored while the next area of interest.

To date, Athena have settled $eight.5 mil financing as well as the products it makes is noted on serviceability aggregator Quickli, identifying the necessity of it broker tool.

Starkey told you Athena went on in order to level right up checklist RMBS financial support, because seen in February on the $1bn Olympus package. He told you that it influence are from the straight back regarding solid buyer interest in securitised loans, combined with the fresh business’ development by way of quality lending.

At the both a customers and market height, i’ve focused on building a business with a reputation to own prioritising transparency, equity and you may stability to transmit powerful really worth, told you Starkey.

The fact we supply good assortment in financial support at a money height that have financing regarding big regional and you can offshore banking institutions signifies all round standing in our team in the industry.