HELOC against. home security financing: Which is an easy method to invest in Your following Restoration Opportunity?

10 октомври, 2024

So it specialist post will help you examine HELOCs compared to Domestic Equity Loans. Immediately after reading this article guide you’ll know utilizing Family Security Fund versus HELOC to have renovations, together with when it’s far better fool around with per funding option.

You may possibly have observed property Equity Loan and you may house guarantee personal line of credit (HELOCs) – but you will be nonetheless trying to puzzle out just how beneficial they might become toward financial support biggest orders this way house restoration enterprise you have become believed – right?

HELOC and House Collateral Loans are considered the wisest cure for pay money for home improvements such as for instance a bathroom remodel, cooking area renovation, or house improvements. Have a tendency to home owners use HELOCs to finance significant renovation systems, because the interest rates is actually lower than he or she is on the private fund and you will handmade cards. T?hat’s because you can constantly generate guarantee because you reside in your property then availability your home guarantee when you require it having a house guarantee loan otherwise HELOC.

In short, They are both resource possibilities that enable you to borrow against new collateral of your property. Nevertheless, there are two line of biggest distinctions: HELOCs (house collateral personal line of credit) promote funding thru a line of credit, when you find yourself Family Equity Financing bring funding via a lump sum payment. A house guarantee loan is actually an alternative to the new HELOC, so there several extremely important differences between the two selection.

There are many different almost every other unique differences between property Collateral Financing versus Family Collateral line of credit that you must know if you’re thinking about these types of financial support selection.

There is written it pro help guide to make it easier to understand the huge difference ranging from HELOCs against Domestic Guarantee Financing, utilizing home equity loans and you may HELOCs having do it yourself, the way they work with capital home improvements, and how far you could borrow.

What exactly is a beneficial HELOC?

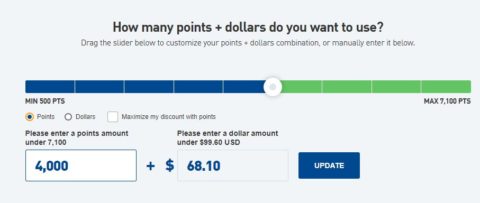

A beneficial HELOC setting household equity line of credit and that is customized since an excellent rotating personal line of credit. HELOCS work by offering an available borrowing limit determined by the home’s worth, extent owed toward financial, and lender’s criteria. There are numerous standards which you can need to qualify for a good HELOC, not, they will differ based your own lender. HELOCs enjoys varying prices, in lieu of repaired prices. This is why the interest levels usually vary with regards to the field as you are paying back the loan. HELOCs are apt to have a couple phases – the latest draw phase additionally the repayment phase. The brand new draw stage basically lasts as much as ten years which will be the brand new day as much as possible make use of personal line of credit if in case might such as for instance.

The greatest advantage of playing with a house equity line of credit is the liberty to access more income since you need they (through your recovery), and you may an extended windows first off payment. The largest downside ‘s the potential to pay off over your requested from your own bank because of the adjustable interest rate.

H?ELOC Gurus against Cons

Restoration Mortgage Pro Suggestion: It’s important to keep in mind that when you’re a beneficial HELOC could possibly offer freedom and you will prospective economy, additionally, it boasts threats, particularly varying interest levels that go up throughout the years and the possibility of borrowing more you can afford to repay. While it is strange, particular banks can give fixed-price HELOCs, otherwise partial fixed-rates HELOCs, where you could turn a fraction of your own HELOC balance on a fixed-rate useful content loan once you start to mark from your line of borrowing from the bank. Oftentimes, such fixed-rates HELOCs get large undertaking rates than changeable-rate HELOCS, or a lot more charges, however it utilizes the lending company. Nonetheless, there are a few HELOCs that have lowest-rates, like the RenoFi HELOC which will help offset the effects of rising interest rates to possess very long restoration projects.