Home loan Certification Conditions: The Self-help guide to Delivering Approved

13 октомври, 2024

- What exactly do lenders select?

- Other variables

- How-to improve your opportunity

User website links to your situations in this article come from couples one make up all of us (pick all of our marketer disclosure with the help of our selection of lovers for much more details). But not, all of our viewpoints was our personal. See how i speed mortgage loans to write unbiased recommendations.

- Minimal credit rating which you are able to need to pick a home varies from the bank and you may loan particular.

- You’ll generally you want a credit score with a minimum of 620 to have conventional finance and you will 580 for FHA funds.

- Downpayment requirements range from no to 20%, with respect to the financing program.

After you get a mortgage, loan providers often review your bank account and look to ensure that you meet the requirements of mortgage program. These may incorporate a minimum credit rating otherwise a good maximum loans-to-money proportion.

The particular standards you will have to meet differ of the loan form of, even though. Some tips about what to learn about being qualified to have home financing.

Credit rating

Many home loan sizes try insured by government communities. Thus, lenders dont deal with consumers that have credit scores below the lowest these groups set.

- Old-fashioned home loan: 620

- FHA home loan: 580 which have good step three.5% down payment otherwise five hundred with a 10% down payment

- USDA mortgage: None, but the majority of lenders need 640 or maybe more

It is vital to declare that loan providers is actually free to put highest minimal credit history criteria than what the mortgage-support communities need. Particular lenders need the absolute minimum get off 660 to own traditional funds, instance.

Mortgage sorts of

As you can plainly see a lot more than, for every mortgage program possesses its own band of criteria, therefore the criteria http://clickcashadvance.com/loans/ivf-loans/ you will need to fulfill depends on and therefore you to you choose. Home financing professional makes it possible to figure out which a person is best to meet your needs.

Examine and replace your credit history

The first step to help you boosting your score are studying in which you stand. You might already look at your credit report free-of-charge shortly after all week with all of about three big credit bureaus (TransUnion, Equifax, and you will Experian) during the AnnualCreditReport.

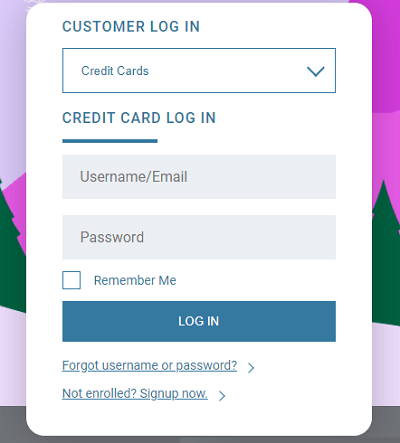

If you learn problems towards the many account, you could potentially argument all of them with the financing agency together with towards financial otherwise mastercard team. When it comes to your credit score, the bank or charge card issuer might provide the get to have totally free. Otherwise, you can fool around with a free of charge credit history overseeing product eg Borrowing Karma otherwise Borrowing from the bank Sesame.

You might also reduce your own credit card stability to reduce the credit utilization speed. And, end applying for people this new kinds of borrowing for the months prior to home financing application.

Most importantly, you need to shell out your own costs promptly each day. Their percentage records ‘s the factor that has the greatest dictate on your own credit score. Strengthening a consistent history of towards-go out money are nevertheless a guaranteed treatment for change your get.

Enhance your earnings or pay down the money you owe

Adding an area gig, trying out more time in the office, otherwise requesting a boost can also be the help you be eligible for financing. Cutting your expense normally, as well.

Help save to have a more impressive downpayment

A more impressive advance payment means the financial institution has to financing your less cash, that it also can make being qualified much easier. Better yet, this may mean all the way down rates of interest too.

Rating pre-recognized

Providing pre-acknowledged to suit your mortgage doesn’t invariably make it easier to qualify, but it’s a sensible flow in advance of finding a property. It can give you a sense of how much you could potentially obtain, exactly what interest you’ll receive, and what kind of payment can be expected. You’ll be able to play with home financing qualification calculator to evaluate such wide variety.

Home loan credit rating criteria Faqs

They may vary because of the financing kind of, however, essentially, a credit rating out of 620 or even more becomes necessary for most traditional mortgage loans. FHA loans allow it to be a beneficial 580 credit rating which have a good 3.5% advance payment (five-hundred having ten% down), if you find yourself USDA and Va funds lack official minimums. Lenders generally require 620 to 640 of these money, regardless of if.

There is absolutely no lay count, your earnings are enough to cover the debt money as well as the proposed mortgage payment conveniently. Depending on the loan system, the debt-to-income ratio must be lower than 41% to help you 45%.

Sure, depending on the loan form of plus things, you might be able to be eligible for a mortgage having a great reasonable if not zero deposit. Va finance, including, don’t require an advance payment.

You can incorporate once again after lowering your DTI or boosting your credit rating or even already qualify for home financing. For mortgage loans, the specific standards you’ll want to see count on the mortgage system, therefore there clearly was a spin modifying the mortgage method of you might be making an application for could help, also.