How can i Qualify for a great Virtual assistant Financing?

03 октомври, 2024

- The nature of provider (reservists shell out high charges than just complete-big date armed forces)

- No matter if you make a downpayment into purchase. Like with origination costs into the of numerous old-fashioned mortgage loans, you can „get on the circumstances“ on the capital commission by creating a down payment to the financing.

- Whether you are with your Va entitlement for the first time, otherwise using it to some other mortgage after paying away from your initially you to definitely. (Charge is actually highest another day doing.)

- People searching Virtual assistant compensation to possess a help-relevant handicap

- People who would-be qualified to receive settlement getting a help-related disability whenever they just weren’t choosing retirement otherwise energetic-obligation shell out

- Surviving spouses of those just who died operating otherwise of good service-related disability

Bank origination charge and you may Va capital charge is placed into the cost of your house and you may financed across the lifetime of the mortgage. That it grows the monthly obligations slightly and you can adds to the total price of the borrowed funds over the existence, however, makes you intimate with the loan without having to spend anything up front.

Step one into the obtaining an effective Virtual assistant financial are examining your own service number (or that your spouse) to ensure that you meet with the requisite qualifications standards.

2nd, you need to receive a certification out-of Eligibility (COE) since the research towards lender that you are a valid applicant to have a beneficial Virtual assistant financing. You should buy good COE in virtually any off three ways:

- Over an online means in the VA’s eBenefits web site.

- Provide suggestions of your army services so you can a loan provider that situations Va loans, in addition they can be build an effective COE to you.

- Fill in and you will submit a COE request form of the send.

In the event your credit history is found on the reduced front side, you may not be tested by most of the loan providers

Recording the qualifications to get an effective Va mortgage doesn’t automatically entitle you to definitely that. You still must get and you can be eligible for financing of the fulfilling the brand new lender’s borrowing from the bank and you can money certification. The brand new Virtual assistant sets guidance for those certificates, but for each and every bank has some discernment within the choosing the credit requirements.

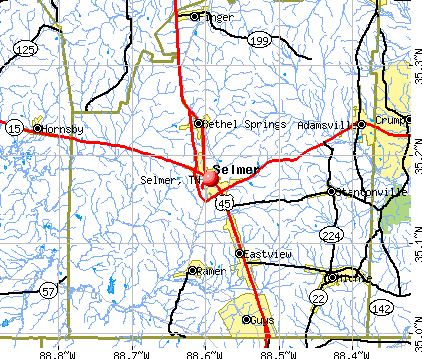

Doing work in this Va assistance, loan providers also lay their particular rates and you can charges. Many loan providers market and provide the Va loan products, but if you need help in search of an excellent Virtual assistant mortgage issuer, you might contact the brand new Va Regional Mortgage Heart one to serves the latest town in which you plan to buy a home.

It is preferable to recognize a loan provider and get prequalified for your loan before you start looking a house. Prequalification enables you to recognize how much you have got to spend on your house. To obtain prequalified, you are able to usually have to meet with the lender’s minimum credit score requirements and show proof sufficient money to help make the monthly mortgage repayments.

Additionally, it is wise to apply to numerous loan providers whenever seeking to a Virtual assistant loan. Plus when the your entire apps was acknowledged, there can be a spin one bank deliver a much better interest rate than simply other. As with any mortgage, search for an informed price and terms and conditions you can purchase.

Do Now i need a good credit score to help you Qualify?

Lenders one procedure Va funds put their own credit history conditions, but usually the criteria for the Va money be much more easy than those having antique finance. Although conventional mortgage issuers look for an excellent FICO Get ? from 670 or higher, issuers away from Virtual assistant money get deal with applications out of borrowers having a good FICO Score only 620.

As with antique mortgages (or any other types of consumer credit), it’s best to check your credit rating before you incorporate, so that you have a notable idea where you are. Highest credit ratings generally mean ideal lending conditions, together with focus and charges, which can save loans Louisville AL thousands of dollars along side lifetime of the loan.