How-to Fund a property Inclusion: 11 Steps in order to Discover the cash to enhance Their Area

10 ноември, 2024

Display

There are many reasons a resident will discover themselves in need off additional liveable space. Maybe their loved ones continues to grow, they require space for an aging mother, otherwise they have has just come working from home full-some time and need a dedicated office space. However, although some residents could see which since the opportunity to improve so you can a larger possessions, others may prefer to stay static in the bedroom he’s worked hard to become property.

People who commonly ready to part with their property tends to be keen on the idea of a house remodel otherwise addition, but with one significant home improvement, homeowners must be willing to thought several affairs prior to they can split surface on the enterprise-also just how to security their residence renovation will set you back. So you can explain which complex starting, property owners may start which have examining this action-by-action publication about how to finance property loans no credit check Coventry Lake introduction.

Before you begin…

Whether or not including an improvement in order to a house are a pricey plan, ultimately, which funding is generally definitely worth the prices for almost all property owners, improving the total value of their property.

However, for a while, people will need to are able to purchase its home inclusion can cost you. There are numerous an effective way to fund a property introduction, before home owners can choose a funds choice, they are going to need to understand numerous issue, including the fitness of the earnings in addition to extent of the opportunity.

1: Create a spending plan in accordance with the type of family introduction your want to build.

Family enhancements features the typical cost of up to $fifty,000, even though home extension can cost you can differ somewhat according to proportions and you will difficulty of addition. To determine questioned can cost you and place a spending plan, homeowners should try for the type of domestic addition they wish to create. There are numerous models to take on, between you to-place, bump-aside enhancements in order to old-fashioned full-dimensions improvements.

To select the right type of domestic addition, people will have to think about the implied use of the place in addition to people design restrictions one to ple, homeowners which do not have the place to grow outward get as an alternative determine to create up that have one minute facts. With the help of our issues in mind, homeowners could possibly get an idea of their asked will set you back, function a spending plan which can help you choose between financing solutions.

2: Look at your newest money to obtain a concept of this new designs out-of funding you could qualify for.

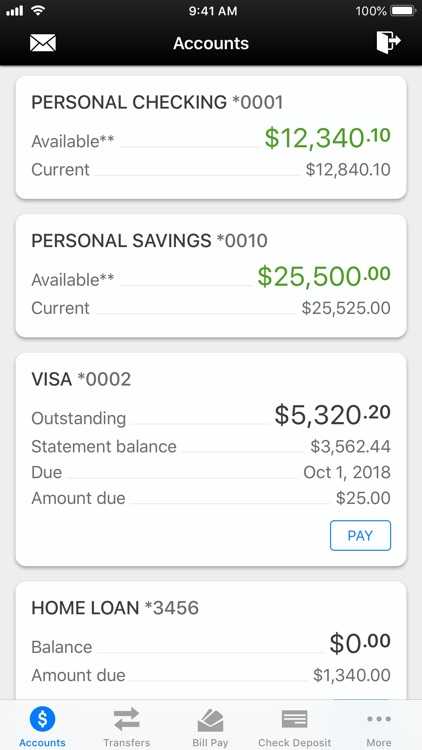

In advance of capable examine banking companies, lenders, and other kinds of capital, home owners also have to gauge the fitness of the earnings. Qualifying towards the financing possibilities on this page requires home owners to generally meet specific requirements, including money, credit history, and you may personal debt-to-income requirements.

To locate a sense of the credit options that may be open to them, homeowners will have to directly view each of these items. They will also want to look at exactly how an additional financing commission you are going to match their month-to-month budget, choosing a finance choice that will enable them to availability brand new money needed instead borrowing more than will become necessary.

3: When you have security of your house, thought taking out a home equity financing to cover the newest inclusion.

A familiar option for capital a home introduction is through you to of the greatest household guarantee fund, such as for instance a loan away from U.S. Bank otherwise Flagstar Lender. House collateral refers to the amount of your house belonging to the latest citizen, collected through the years through the month-to-month mortgage repayments. A house guarantee loan is a type of 2nd mortgage that allows home owners so you can utilize their home security and you may located a lump sum payment of money, making it a well-known selection for funding home improvements. Household security money also can offer inexpensive rates than certain of your own other financing readily available because the home is put since the guarantee to the financing, reducing the newest lender’s chance.