Is actually an effective Santander remortgage right for you?

21 октомври, 2024

What is In this post?

If you are searching in order to remortgage, whether to change to a better offer or even use much more currency to have home improvements, Santander can be a good option to adopt. In this guide, i speak about the benefits, processes, and you may factors when deciding on Santander as your lender.

- Competitive Pricing: Santander even offers aggressive costs around the several unit solutions, including repaired and you will adjustable techniques.

- Varied Equipment Choice: They cater to certain needs, like shared control, first homes strategy, and you can right to pick.

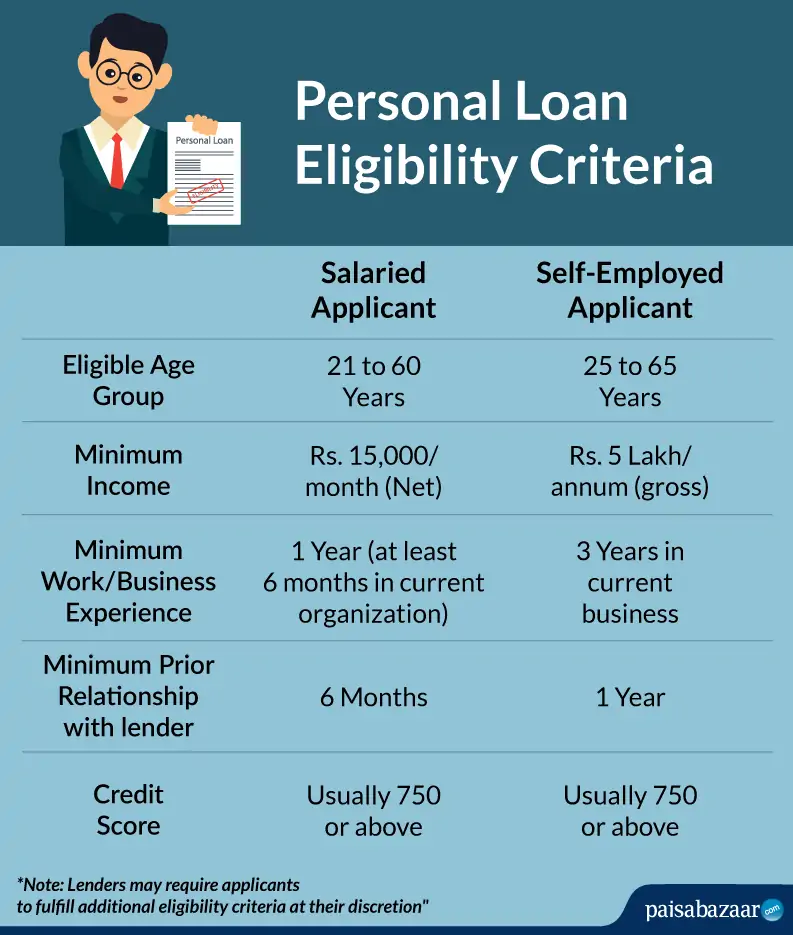

- Versatile Standards: Santander was accommodating for different employment designs, and working, self-functioning, and no-hour agreements. However they consider overtime and you can bonuses to possess cost.

- Streamlined Process: Their underwriting process is fast and requirements minimal documentation.-

- 100 % free Legal counsel: Santander constantly offers totally free legal services getting remortgages.

The length of time really does good Santander remortgage capture?

Overall, you ought to if at all possible ensure it is at least 2 months for your remortgaging procedure, because there is delays with lawyers and records.

The cost of remortgaging in order to Santander is frequently minimal. Often, they provide totally free legal services and you will valuations. The borrowed funds items by themselves have costs, in extremely instances, these may be included in the mortgage.

Once you remortgage to Santander otherwise one lender, look out for any hop out fees from your latest financial. You can always remortgage and you may put aside a speed to own half a year. Such, whether your repaired rate ends in Oct, you are able to initiate the process in may to stop hop out charge from the prepared until your current bargain ends. On top of that, make it no less than two months before your offer concludes in order to stop reverting towards lender’s important adjustable price.

Santander always has the benefit of income multiples of cuatro.5 to help you 5 times gross income, although this can vary significantly. They give you improved earnings multiples around 5.5 times when remortgaging in it instead credit in addition.

There are lots of factors to consider, with preferred as the strategy of your own end out-of the fixed-rate unit. You might reserve an increase around half a year beforehand, allowing you to prevent prospective price develops while you are sustaining brand new independence to change in the event that costs decrease.

Additionally, it may be worth remortgaging just before your existing contract ends up, even with potentially investing a leave fee, should your the package remains useful shortly after factoring about percentage or you have to discharge fund getting surprise objective. Although not, it is well worth checking if the most recent bank will help earliest.

Working with a broker particularly Endeavor can deal with a good Santander remortgage by the contrasting the marketplace to find the best sales, informing your in your options, and you will dealing with files. They’re able to together with aid in finding attorneys, submit the application form in your stead, and supply assistance on the whole process.

Santander remortgage pricing are different with respect to the product, loan-to-worthy of proportion, as well as your financial reputation. It is best to glance at their current rates on their website otherwise consult with an agent for right and you will personalised information.

Whether your remortgage app has been declined, review the reasons provided by Santander. You may have to improve your credit score, lower your personal debt, otherwise boost your money. Imagine seeking to advice of a mortgage broker who will help you understand the options and you may possibly look for option lenders.

Yes, Santander does create remortgages so you’re able to combine personal debt. They will certainly assess your debts to make certain you can afford the new click resources money.

Yes, Santander lets remortgages having renovations. You could potentially acquire even more finance according to their property’s well worth and you will debt facts.

More resources for mortgage loans getting builders, delight get in touch with a person in the fresh new Endeavor team, because of the communicating with [email secure] or contact us into the 01273 002697.

Jamie Elvin

Jamie is an expert in all things mortgages, and our most experienced broker. Connect with Jamie and book name to see how Strive Mortgages can help you.