Look for an unsecured loan coordinated for you

15 октомври, 2024

Mortgage loans, domestic collateral financing and HELOCs constantly charge down interest rates than signature loans, but if you don’t pay all of them, you can treat your residence https://paydayloancolorado.net/julesburg/. Or even want to make use of your home as the collateral, envision a personal loan.

Specific personal bank loan team give personal loan numbers doing $100,000, adequate for even big renovations. Personal loans routinely have fixed rates and repayment terms of 24 to 84 weeks, and could costs costs also origination fees. You will probably need a premier money, low DTI and advisable that you sophisticated borrowing to help you qualify for the newest best prices and you may terms and conditions.

In case your borrowing from the bank is just reasonable, you ounts are typically all the way down, and you will charge can also add with the total price. New apr (APR) is as higher as thirty six% dependent on the borrowing.

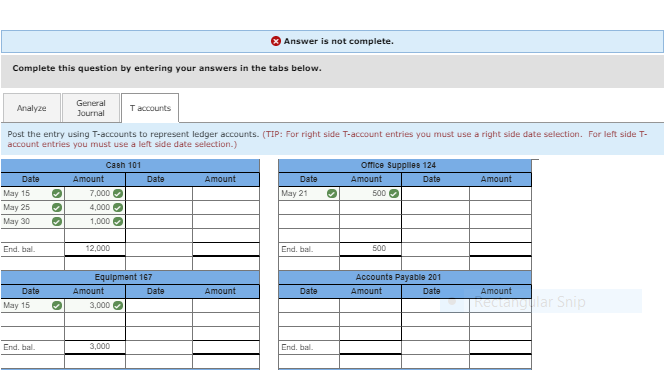

When you take away financing, you will need to know very well what you can afford and you may just what it costs. Such as for example, for individuals who got a great $ten,000 personal bank loan which have an excellent sixty-few days title, 36% Annual percentage rate and you may 5% management fee, you could potentially spend an additional $a dozen,260 from inside the focus to have an entire price of $22,760.

Personal bank loan Calculator

All the info offered is for informative purposes merely and should not end up being construed because financial guidance. Experian dont make sure the precision of your overall performance provided. Your own lender may charge almost every other costs that have perhaps not become factored contained in this calculation. This type of performance, in accordance with the advice provided by you, depict a price and you should consult your very own economic mentor regarding your variety of demands.

What Credit rating How would you like having a property Improve Loan?

Being qualified getting a house equity mortgage, cash-away refinance otherwise HELOC generally requires good to higher level borrowing (good FICO Score ? of 670 or more). Whether your credit is actually fair (a beneficial FICO Get out-of 580 so you can 669), you might still be capable of getting that loan, but it might has a top rate of interest, thus you can pay furthermore go out. Before applying having a house upgrade mortgage, look at your credit history and credit history. If for example the credit history need an increase, are such tips adjust they:

- Pay down credit debt. Their borrowing use price is better significantly less than 29% of your own available credit.

- Promote one later levels current.

- Build all your loans repayments promptly.

- Never make an application for any kind of the latest borrowing.

- Create Experian Increase o Which 100 % free solution adds for the-time electricity, mobile and you will online streaming services costs into the credit report, potentially giving your own FICO Score a simple boost.

- Disagreement one wrong recommendations on your credit history.

Where to get a house Update Mortgage

Given a profit-out re-finance, house equity loan or HELOC? Get hold of your newest mortgage lender observe what they could offer. Upcoming rating also offers from other home loan or house security loan providers, contrasting interest levels, settlement costs, payment terms and you can charges. Contemplate using a mortgage broker who’ll get rates and suggestions regarding several lenders.

Signature loans are available of banks, borrowing unions an internet-based-merely lenders. Start with your bank otherwise borrowing from the bank partnership, after that comparison shop. But do not pull the process away long. After you apply for a loan in addition to lender inspections their credit, they factors a hard query into the credit history, which can briefly ding your own rating by several circumstances. Too many tough concerns normally negatively apply at their borrowing scoreplete most of the the loan software within a fortnight, although not, and they’ll feel handled in general query. Certain loan providers will prequalify you for a loan, hence matters as a mellow inquiry and does not effect your credit scores. Experian normally fits you with loan providers that fit their borrowing character.