Misunderstandings On Family Cost Might possibly be Leaving Family Regarding Doing Generational Wealth

31 декември, 2024

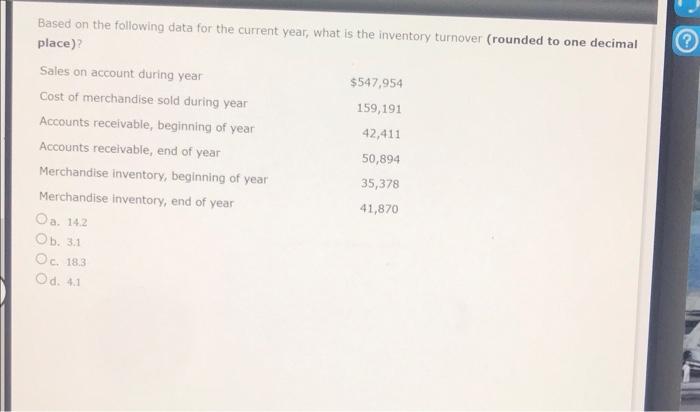

When you yourself have area on the finances, you could potentially think refinancing so you can a smaller term financing out-of 10 in order to fifteen years one carries a diminished rate. Moving to a smaller financing will most likely imply higher month-to-month costs, your home would-be paid quicker therefore costs shorter focus total.

Cash-Away Re-finance

When you have guarantee of your home, you should buy a cash-away re-finance and rehearse the cash to cover do-it-yourself strategies otherwise combine loans of playing cards, numerous mortgage loans otherwise credit lines.

Recall, the latest guarantee you may have in your home usually get rid of if you choose a money-out mortgage. Eg, in the event your house is really worth $250,000 today plus leftover prominent is actually $150,000, then you’ve $100,000 https://paydayloansconnecticut.com/new-haven/ in the equity. If you take aside $50,000 inside bucks along with your cash-away refinance, you now have $50,000 in home security.

By using the cash having do it yourself, it is possible to recoup a few of the lost equity. Additionally, if you opt to use the money in order to consolidate the debt out-of high-interest rate handmade cards, it is critical to be sure to cannot charge way too much for the their handmade cards again and you will chance shedding your own refinance savings.

Proceed to Better

That have , there are it all (every thing, at the very least), and then we on a regular basis show the thoughts on a wide array of financial information that could apply to you due to the fact a unique otherwise present homeowner. I and limelight the incredible triumph of your group and you will clients just like the good news is meant to feel shared.

High-Feeling Family Renovations

Are you a primary-big date homebuyer? Are you currently thinking of updating otherwise downsizing? Or you should gain benefit from the guarantee on your own current home. In spite of how big, otherwise short, your property plans was, the audience is right here to greatly help produce for which you have to wade.

NMLS ID: 279738 | California ID: 41DBO-61467 | Registered from the Institution out-of Monetary Safety and Advancement underneath the Ca Domestic Mortgage Lending Act

Deeper Nevada Home loan are a subsidiary from Higher Las vegas Borrowing from the bank Union (GNCU). Apr = Apr. Annual percentage rate is the price of borrowing from the bank currency, shown due to the fact a yearly fee. To possess mortgage loans, leaving out household equity personal lines of credit, it provides the pace along with other costs otherwise charges. Prices and you will words is at the mercy of changes without warning. Prices was getting illustrative intentions just and you will suppose a debtor which have a credit rating away from 700 or even more, which might be highest or less than your credit rating. Varying Price Mortgage (ARM) finance try susceptible to rate of interest, Annual percentage rate, and fee raise after every alter months. For instance, good 5/5 Case ensures that you are going to shell out a fixed speed to own the first 5 years of your financing, and then your rate try at the mercy of transform immediately following all four many years upcoming through the other countries in the mortgage. Rates and you may APRs are based on economy prices and you will can be subject to costs put-ons linked to property particular, amount borrowed, loan-to-worthy of, credit rating, and other parameters. Based on mortgage advice, financial insurance coverage may be needed. If home loan insurance is called for, the mortgage advanced you will definitely increase the Apr as well as the monthly mortgage payment. Their loan’s interest rate all hangs abreast of this qualities out-of your loan exchange and your credit score as much as the amount of time out-of closure. The fresh projected total settlement costs on these rates problems are not a substitute for a loan Guess, that has an estimate regarding closing costs, which you will receive when you get that loan. Actual costs, will cost you, and you will monthly installments on your specific mortgage purchase may differ and you can cover anything from urban area, condition, or any other additional costs and you will can cost you. Not totally all financing options are available in all of the county. The fresh borrower accounts for people assets taxes once the a disorder of your financing. Registration that have GNCU needs getting get a hold of loan choices. That isn’t a card choice or an union so you can lend. Get in touch with a home loan Representative to know the details out-of loan possibilities and programs offered. You can get in touch with one to individually or call Higher Nevada Home loan at 775-888-6999 or 800-526-6999. We conduct business according to the Government Reasonable Houses Act, Federal Equivalent Borrowing from the bank Chance Act, and you can Ca Reasonable A position and Housing Operate.