Mortgage Borrowing from the bank Certificate Taxation Credit Program MCC

01 декември, 2024

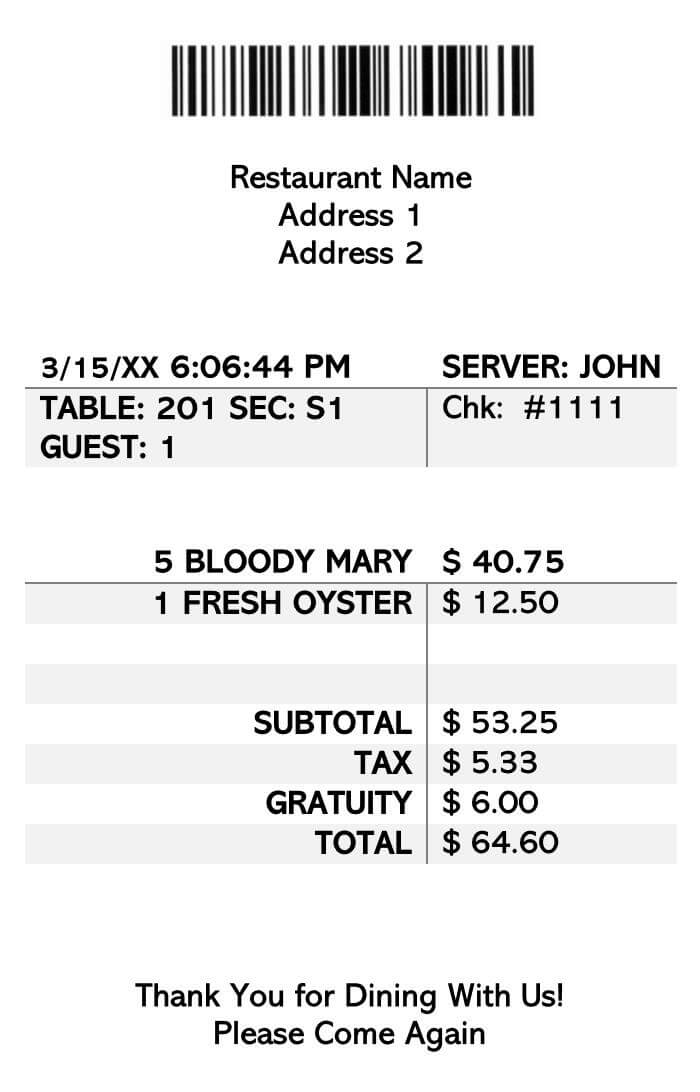

Payment (principal, cuatro.5% attention, financial insurance): $dos,050 Payment per month doesn’t come with assets taxation, homeowner’s insurance policies, nor HOA charge

Virtual assistant Consumers CalHFA Virtual assistant System

The CalHFA Va program was insured because of the federal Experts Government, and is open to all of the provider participants and pros whom see this new VA’s advice. This option is going to be combined with the MyHome or Teacher and you may Staff member Guidelines Program to assist aside having settlement costs.

The new CalHFA Va program was an effective Va-secured loan offering a great CalHFA fixed interest rate first mortgage. The borrowers need take the house as their top quarters within this two months off mortgage closure. Product sales rates limitation was $660,000 for everybody off Ca. Take a look at CalHFA website to have latest pricing and you will fees.

Professor and you may Staff member Guidance Program

This new Professor and you can Personnel Direction System is actually for qualified teachers, administrators, categorized employees, and you can employees employed in one Ca K-twelve public school, together with personal constitution universities, university district practices, and you may state/extension colleges. The maximum amount of these deferred-percentage junior loans was 4% of the conversion process rate otherwise appraised worthy of, whichever try shorter.

Cal-EEM + Offer System

The brand new CalHFA High efficiency Financial + Grant (Cal-EEM + GRANT) Financing Program brings together an enthusiastic FHA-covered first-mortgage mortgage (Cal-EEM), that have an additional EEM Offer. Look at the CalHFA website having current rates of interest. So it Give would be to assist pay money for high efficiency developments https://elitecashadvance.com/installment-loans-ut more and over the limit deductible FHA EEM amount borrowed.

The power Productive Mortgage already lets an effective homebuyer acquire a lot more finance getting opportunity developments. The full deductible will cost you of one’s developments that may be eligible having capital as part of the financing was either 5% of property’s well worth, not to ever exceed $8,000, otherwise $4,000, any sort of try deeper.

The new CalHFA EEM Give is actually for around cuatro% of your first mortgage complete loan amount, in addition to Beforehand Mortgage Advanced. If the a homeowner resides in our home for three age, the latest 4% offer is completely forgiven, plus the resident need not pay it off.

The Cal-EEM + Give system will be together with the ECTP, revealed more than. Cal-EEM is for purchase deals simply. Refinances are not welcome. This choice is not simply for very first-date house borrowers. Even though you possess possessed property prior to now three age, you might qualify for this method. Although not, during the time of mortgage closure, you can’t have almost every other possession demand for a special home-based dwelling. You will want to entertain the property since your no. 1 house in this two months out of closure.

Energy-efficient Advancements

- The fresh Heating and cooling program

- Restoring or replacing a fireplace

- Insulation from attics, crawl rooms, water pipes, ducts

- Weatherstripping

- Time Superstar dropping cup doors and windows

- Having effective and you can couch potato solar power technology

- The brand new times-effective ice box and/otherwise dish washer

A home Opportunity Score System (HERS) statement needs. (Read more about Family Time Assessments.) This HERS declaration usually choose qualifying time advancements to suit your possessions. You may want to discover other ways to finance green enhancements.

Analogy Cal-EEM + Grant

$500,000 household cost Limit funded developments that have EEM: $8,000 4% Give (predicated on amount borrowed, and up front home loan insurance policies): everything $19,800 Complete Finance Available for Energy Advancements: $27,800

CalHFA also provides the loan Borrowing from the bank Certificate Tax Borrowing System (MCC). This might be a federal borrowing that will clean out potential tax accountability, freeing up currency that may go towards the a monthly homeloan payment. A portion of yearly home loan attention is actually turned into a direct dollar-for-dollars income tax credit on your private taxation return.

Great at San diego County are $564,353 to possess a low-focused urban area, and you can $689,764 to have a specific area. The MCC should be layered with all of the CalHFA financing programs explained a lot more than. After you level programs, the reduced conversion process price limit enforce.