Playing with a home Collateral Personal line of credit (HELOC) Getting a downpayment

14 октомври, 2024

Gathering everything that you ought to purchase a house is going to be a daunting task. That will be just in terms of the paperwork. Having the financials managed is an activity other completely.

When you find yourself buying your very first family, there are a great number of hoops so you can jump compliment of, perhaps not the least from which is getting minimal deposit.

With each home loan that’s considering, the borrowed funds amount is contingent into the advance payment. Many creditors and financial advisors recommend a great 20% down-payment. The greater the down-payment, then your reduce your interest rate commonly generally be.

The hard point are getting one to down payment to each other. If this sounds like your first domestic and you’re looking to help save and you can conserve to have a downpayment, then to shop for a property might feel like a distant fantasy.

You’ll find different ways to have that down payment money, specific shortcuts that avoid the typical preserving 10% of one’s money for a long time before you buy property recommendations. What exactly are they?

Financing off a close relative

A loan of a member of family is actually officially a type of credit, however, instead of all the judge strings attached to it. Essentially, if the a reasonable aunt otherwise grandparent often ft the bill to own their deposit, then you are about clear, relatively talking the.

You’re going to have to reveal towards the standard bank where in fact the currency originated from. not, most finance companies and you will borrowing unions you should never balk within family unit members loaning currency for off repayments. Its a fairly a normal practice.

You can find positives and negatives to that. The new expert is that you can score a loan to the home. The fresh new cons was step one) there may be tax ramifications having acquiring something special of that dimensions and dos) it has been said that this new terrible individuals simply take money from is actually your loved ones. As to the reasons? Because it alter your family vibrant and certainly will damage historical relationships. It’s something you should consider.

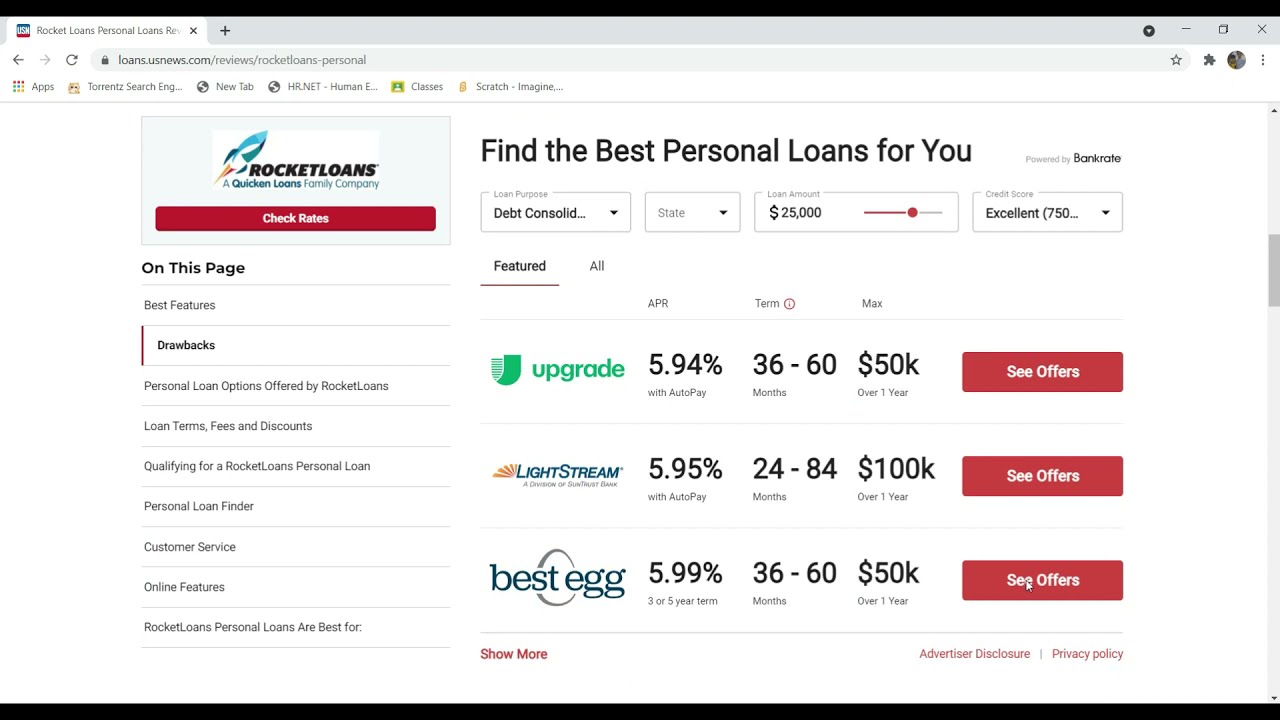

When it comes to an unsecured loan, you can make cash advance Franktown use of it once the a down-payment towards the an effective house. However, it can be very difficult to get a personal loan during the the quantity needed to generate a good 20% down payment. And, when you are bringing a credit line towards the deposit, then your effects of that credit line are going to connect with your capability to obtain the home loan.

Should your mortgage certification are now being calculated, the loan expert can look in the what outstanding expense and assets you really have. If however you provides an enormous unsecured loan to own 20% of one’s property value the home, that will be a warning sign to your professional.

One home loan pro would need to pick if you could potentially pay out of both loans and, if you don’t, which you’ll standard toward. If your pro believes you can easily default into the mortgage, then chances are you wouldn’t become approved.

But not, unsecured loans usually are used because the down money getting short commands. Which is often real to the purchase of cellular land, in which the total price (and therefore the down-payment) actually very high.

A proven way you might borrow funds and then make a deposit is by using a home collateral mortgage. Needless to say, what this means is you currently have a home which you maybe not just own, but i have security from inside the. However,, for people who meet this type of standards, then you may control that security to locate a down-payment to possess both another type of family or an extra domestic – possibly a rental possessions or a beneficial cabin.

Summary

Long lasting your situation, you will have to make sure that one can generate your own monthly obligations, loan payments, (together with closing costs) and you can do everything at the same time. Try to pay the credit line inside the introduction into mortgage.