Safer and Reasonable Administration to possess Home loan Certification Operate

03 декември, 2024

Household Equity Personal line of credit

The reasonable-focus House Equity Credit line is usually the best choice. That have a house Security Personal line of credit, your withdraw currency since you need they and shell out appeal just towards amount of cash you employ from your own offered range of credit. Since you repay your loan, you might borrow against the primary once again.

Running your house has a lot from perks. One to major work for is the guarantee you get by paying off your own mortgage historically. That have a cards Union Home Collateral Credit line, you could potentially make use of this guarantee to help you use the money you you need now. Perhaps not a homeowner but really? Trying to re-finance otherwise part of to help you a larger household? You will find First Mortgage loans, as well! The knowledgeable private provider representatives will assist you to purchase the product that’s true to you personally.

Use to 90%* of your own current appraised property value the majority of your home, without very first Home loan equilibrium. That have a property Security Personal line of credit, you could borrow as low as $ten,000 as much as $200,000. You must mark no less than $ten,000 on Household Guarantee Credit line at closing.

Monthly payments

Repayments are based on the amount taken out of your line of credit, instead of your own full available credit line. Payments are calculated on the a great 15-12 months label with the absolute minimum monthly payment out-of $45. There are no pre-fee punishment.

Low Cost

The pace to have a property Equity Line of credit are in accordance with the latest Perfect Rates as had written on Wall surface Street Record. Whether your Best Rates alter, their price could be adjusted active new few days following the rates change. The rate you only pay won’t be more several% otherwise slip less than step 3.25%.

Lowest or no Closing costs**

An effective USPS FCU Household Equity Credit line Financing can cost you reduced than most other resource possibilities due to the fact all of our prices try extremely aggressive. USPSFCU will pay closing costs around $1,000 for professionals within Dating Advantages system.

Opening Money

It’s not hard to accessibility your residence Equity Personal line of credit whenever you may have an excellent USPS FCU family savings, Charge debit credit, and Virtual Branch family financial So you’re able to with ease availableness your own collection of credit simply import money from your line of credit on savings account thanks to our very own 24/7 attributes including Digital Department otherwise Los cuales Cell Teller, then you may make use of Visa debit credit otherwise produce good individual consider.

Draw Months

You have fifteen years to attract money from your property Collateral Personal line of credit. Monthly premiums are required during this period. After fifteen years, no additional brings are permitted. You’ll then provides an extra fifteen years to settle the remainder harmony through at the least your own minimal month-to-month called for payment since shared in your month-to-month account report.

Family Collateral Credit line Software

**The loan must romantic, be install on the Borrowing Commitment membership, and remain discover to possess 3 years, or else you will be the cause of reimbursing the credit Relationship to possess all the settlement costs incurred because of the Borrowing Commitment, such as the price of an appraisal.

Important info:

- Family Equity Credit lines aren’t in Tx, Puerto Rico or perhaps the Virgin Countries.

- Limit LTV (loan-to-value) proportion is 90%. LTV and you can amount borrowed is dependent on the new applicant’s credit score.

- Appraisal and you may Identity Insurance called for.

- Possessions Insurance requisite. Flood Insurance policies may be needed, with regards to the location of the possessions.

- No yearly percentage.

- Settlement costs can vary according to the location of the property together with number of the borrowed funds. To have loan amounts of $100,000, settlement costs generally speaking range between $800 and you may $dos,800.

- USPS FCU should be in the a first step one otherwise 2nd lien position with the action of the online payday loan New Mexico equity held when it comes down to USPS FCU Household Collateral Line of credit.

- Demand a taxation coach concerning deductibility interesting.

- Almost every other limitations get incorporate.

step one Limits connect with earliest-lien ranks into the Family Guarantee Line of credit. Contact our home Collateral Department before you apply to receive additional info.

The latest Safer and you can Fair Administration to own Financial Licensing Operate (Safe Act), needs borrowing from the bank relationship real estate loan originators in addition to their along with their establishments to join this new All over the country Mortgage Licensing Program & Registry (NMLS). A list of the borrowed funds financing originators from U. S. Postal Solution Government Borrowing from the bank Commitment can be obtained below:

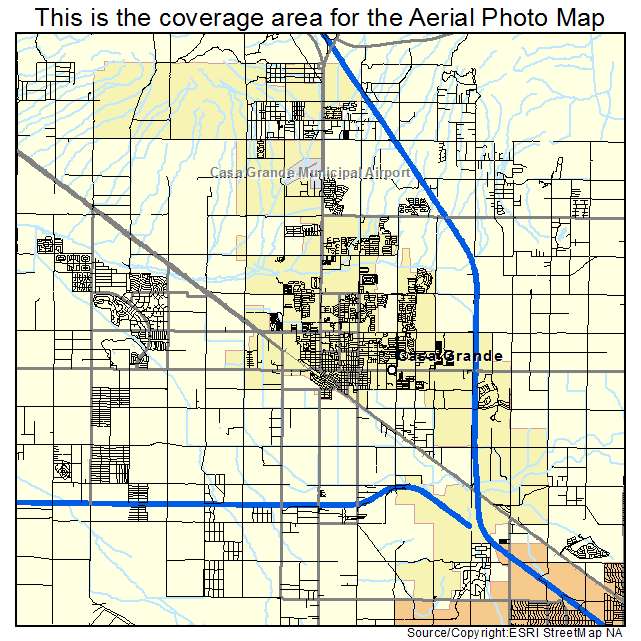

The fresh new HMDA study on the our very own residential home loan credit are available for comment. The information reveal geographic shipments away from money and you can programs; ethnicity, competition, sex, and you can earnings of individuals and you may individuals; and you can facts about financing approvals and you will denials. Inquire during the 800-877-7328 about your places that HMDA studies could be checked.