Student loan Dollars-Aside Refinance: What you should Discover

21 септември, 2024

paydayloansconnecticut.com+hazardville cash to go and advance america

With over $step 1.75 trillion from inside the student loan obligations in the us, consumers was looking for forgiveness opportunities. Even though some forgiveness is out there so you can educators and personal servants into the particular ranks, these types of choices are not available to any or all, making of a lot selecting a remedy.

Student education loans ban individuals regarding and also make significant existence decisions, particularly investing in an advance payment having a home. The good news is, borrowers wanting homeownership can take advantage of a student loan cash-aside re-finance system. This choice also offers residents the flexibleness to settle high-notice student loans while you are probably refinancing in order to less home loan interest price.

Even though this system is not just a forgiveness system, it does ensure it is borrowers to help you tie student loans and you will mortgage payments into the an individual payment at the a lesser interest.

In this post, i break down that it education loan bucks-away refinance program to help you see whether or otherwise not they is great for your problem.

What is actually a cash-Aside Refinance Purchase?

Due to the fact 1970, mediocre education loan debt has grown of the more three hundred per cent. That have on average over $31,000 within the https://paydayloansconnecticut.com/hazardville/ student loan loans each graduate, it’s no wonder borrowers are seeking education loan forgiveness programs. Along with the software i listed above, the selection is growing, particularly condition home loan apps that offer some otherwise total personal debt rescue.

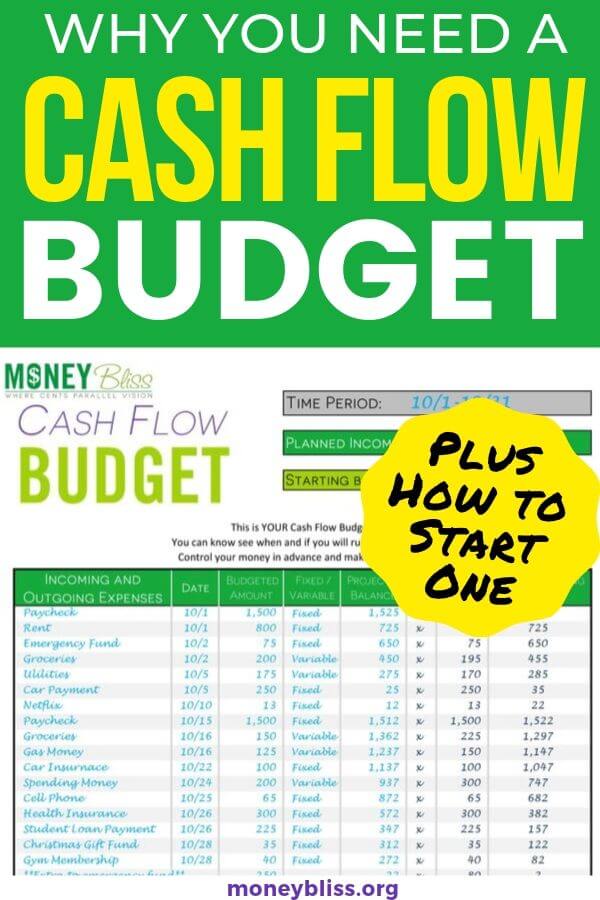

Probably one of the most well-known education loan save choice has been student loan bucks-out refinance applications. Such programs are similar to a classic bucks-out re-finance exchange, enabling home loan owners to replace a classic financial which have a good new one who may have a much bigger amount than just due to the early in the day mortgage. This will help borrowers use their house mortgage to get into dollars.

Just in case you have to pay college loans, an educatonal loan bucks-away refinance is largely the same as a profit-out re-finance system, however the extra money regarding new financing pays off college student loan personal debt.

Shows of Student loan Dollars-Aside Re-finance Software

Student loan dollars-aside refinance software make it student loan personal debt installment thanks to a home loan re-finance. Is eligible, a minumum of one education loan need to be paid down from the sending money on the student loan servicer within closing.

Most Uses of the Bucks-Out Refinance

Although the pri is to pay-off student loan loans, the loan may also be used in other indicates. In case your borrower does not want to settle the fresh new entirety off their college loans, they could want to pay off most other home loan-relevant personal debt. Like, individuals should pay off:

- A preexisting first-mortgage mortgage.

- Financing to fund can cost you with the a special structure house.

- Settlement costs, affairs, and you may prepaid things, not including a home fees that are more than 60 days delinquent.

- Subordinate liens regularly buy the possessions otherwise included in the the brand new financial.

Concurrently, the latest borrower ount isnt more than dos per cent of the brand new re-finance matter, or $dos,one hundred thousand. This new debtor can be refunded from the lender when they accumulated overpayment away from costs compliment of federal or condition laws and regulations or rules.

More info

To get some great benefits of an educatonal loan refinance system, the borrowed funds have to be underwritten by Pc Underwriter (DU), an underwriting program you to definitely Federal national mortgage association often spends and you will, occasionally, this new Government Housing Power. In the event DU will not choose such transactions, it does send a message whether it seems that college loans is actually designated paid back of the closing. So it message will state lenders of mortgage requirements, but the financial need to make sure the loan fits all of the standards beyond your DU.

Correspond with a loan Officer Throughout the Student loan Cash-Away Home loan Requirements

On radius, we do not envision home buying has to be tough. And then we dont envision you have to place your hopes for homeownership for the keep on account of student loans.

When you’re interested in learning about student loan cash-away re-finance possibilities-including an educatonal loan re-finance program-get in touch with a Loan Officers. They might love the opportunity to leave you facts.