The difference between Mobile And you can Are available Property

26 декември, 2024

4. It’s not necessary Primary Credit

It’s not necessary finest credit so you’re able to be eligible for a cellular household term loan. This is because the financial institution use your house due to the fact guarantee into loan, and they are, thus, more willing to focus on people who have shorter-than-prime credit.

5. You can buy the cash Easily

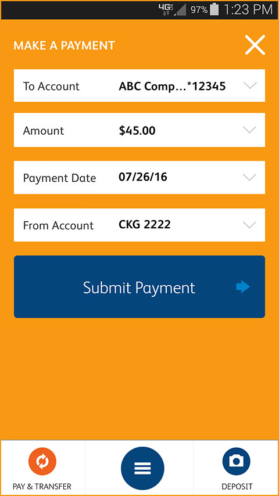

An additional benefit regarding a cellular house term loan is that you can often get the money easily. The reason being the whole process of delivering a classic mortgage can also be getting really slow and you can complicated.

Which have a mobile family term mortgage, the procedure is much simpler, and usually have the currency within months or weeks.

Several key differences between cellular and you will are available house can be noted prior to getting often version of financing. With a cellular home identity financing, you could potentially immediately accessibility your house whether it’s found on belongings owned by you or not.

You don’t have an identical amount of credit history just as in a manufactured family identity financing; some loan providers also bring funds to people which dont qualify for traditional mortgages. The interest rate to have loans in Lillian mobile home loans is oftentimes below one to having are made home loans also.

Cellular house might be went to as required, if you find yourself are formulated residential property never. Simply because he could be built to endure long lasting position into the that location.

Mobile property typically have smaller insulation than simply are built land, which makes them hotter/very hot regarding the winter months and you may cold during the summer.

Cellular family construction usually uses smaller content than simply traditional manufacturing, that may trigger straight down-top quality ends up or architectural dilemmas throughout the years.

Exactly what are the threats from the mobile domestic title loans?

You will find some threats from the mobile domestic term financing, however, total they may be a very useful option for people who need money. Listed here are around three of the most extremely prominent threats:

Funds might not be paid off punctually. Cellular domestic consumers tend to have smaller equity inside their land than traditional home loan consumers, so there was an elevated risk that they will not getting in a position to repay the mortgage toward prime time.

Consumers may end right up owing more funds than is lent. In place of conventional mortgages, where lenders generally assume one to pay-off your entire loan count plus interest and you can charges, that have cellular domestic name loans, particular individuals finish due extra cash due to the fact financial does not sell otherwise dispersed the house until its completely paid back.

If the things happen suddenly and slow down the deals techniques, the latest debtor can become delinquent on their home loan and you will owe also more funds than in the first place borrowed.

Defaulting into a cellular family label financing can result in property foreclosure legal proceeding and it is possible to seizure of the property by the creditors.

This might result in devastating economic consequences both for your (the newest borrower) Plus family unit members who live from inside the/around their truck park household.

The way to handle a cellular household identity loan you simply can’t spend straight back

Dont worry; there are lots of options open to you. You can refinance the borrowed funds or take out another home loan on your top quarters.

Yet not, this type of solutions will most likely require more cash down than currently available on the checking account. In this case, thought a house guarantee type of the financing (HELOC).

A good HELOC makes you borrow as much as 100% of your own value of your property facing future money and you will payments. Thus giving you access to loans easily and you will without the need to lay any down payment or pay interest levels generally greater than men and women to own antique finance.

If you find yourself HELOCs are not usually the best option for everyone, they can be a reasonable answer to begin repairing or rebuilding their mobile house kingdom!