The lending company ought to provide this new Ce on the debtor within this three days of the mortgage application

04 декември, 2024

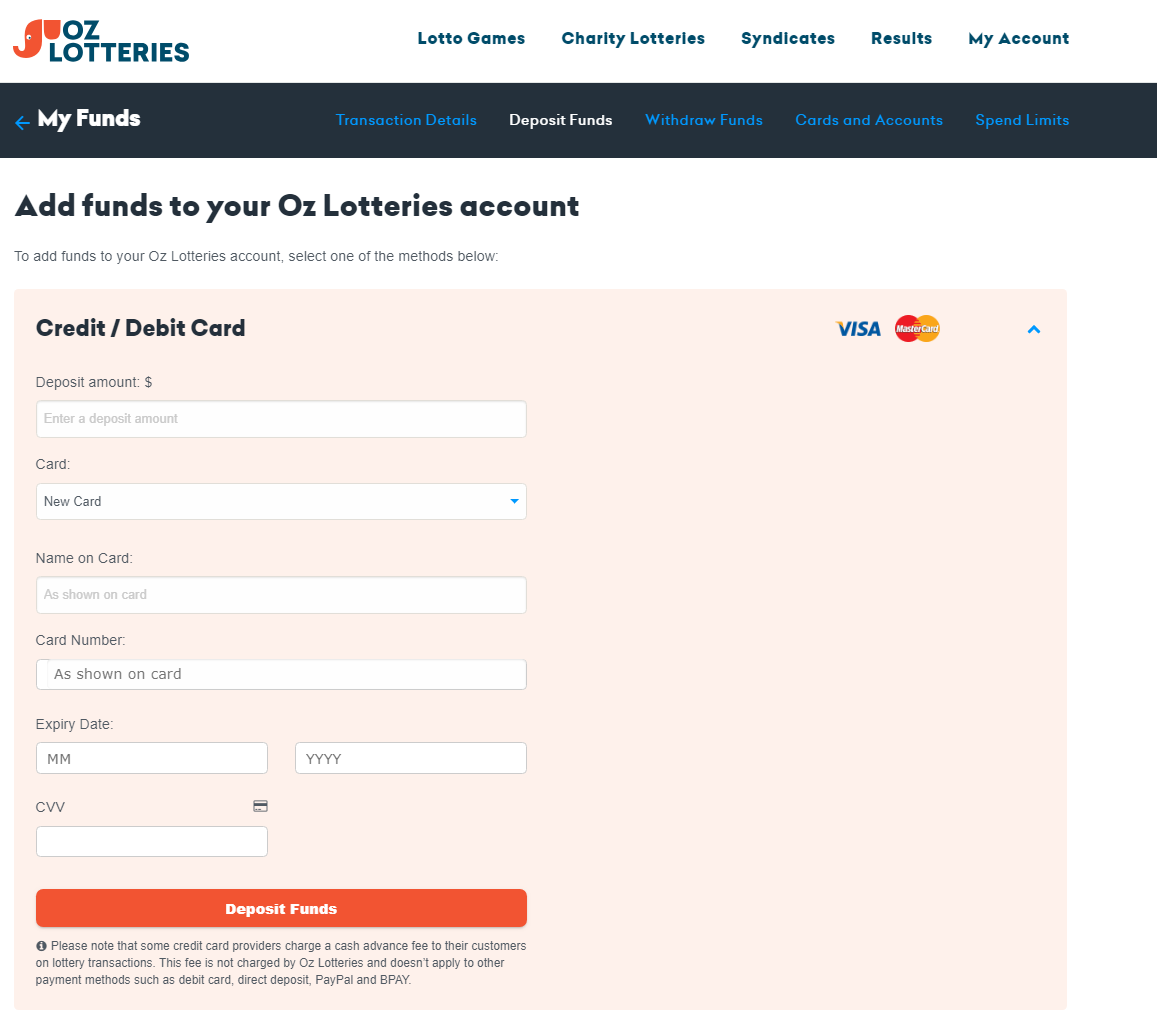

Rather than the 1st Information-in-Lending report and you will Good-faith Imagine, individuals can get a special revelation known as Loan Imagine (LE)

- Thursday, September 17: eleven an effective.yards. in order to a good.yards. Et

- Monday, December 15: eleven good.yards. in order to good.meters. Mais aussi

Wells Fargo is invested in definitely supporting the the fresh new-construction community and is serious about that gives the various tools, tips, and important information so you’re able to create your organization.

New files your customers find once they get a loan at closing day go for about to evolve for the very first amount of time in over 3 decades.

For many years, possible during the Financing Operate (TILA) and also the Home Payment Actions Work of 1974 (RESPA) has actually necessary loan providers to provide two independent forms to consumers applying having home financing plus one a couple forms in the closing day. New TILA-RESPA Included Disclosure laws (TILA-RESPA getting brief), which goes in impression that have software received into the or just after , integrates these types of versions, leading them to significantly more clear, to the point, and you may consistent, to make certain that individuals can top see the home loan process.

Wells Fargo Home mortgage is prepared to incorporate these conditions, and certain your people will enjoy a beneficial experience when it’s time and energy to get their brand new family. Developers will help generate one to sense also much easier because of the discovering the brand new statutes which help customers avoid shocks of the means the right requirement.

Starting with brand new programs adopted otherwise after , TILA-RESPA mandates the newest revelation variations to possess family buy and you can refinance purchases (but not having home collateral credit lines). And as opposed to the last Knowledge-in-Credit declaration and you can HUD-step one, consumers get an ending Disclosure (CD).

Both brand new disclosures are created by the Individual Financial Coverage Agency once detailed individual and you will business research to safeguard borrowers and give them a definite article on mortgage enjoys, pricing, and you can charge so that they can make better monetary choice.

This new Ce and Video game enjoys fresh visuals and can include a number of data which can be noticed on customers. Both bring here is how much cash the brand new debtor needs to intimate, a formula that the first Facts-in-Credit statement and Good-faith Estimate didn’t have. A beneficial estimated costs area shows the brand new projected full payment, similar to just what a buyer would get a hold of towards most recent first Truth-in-Lending document.

Following debtor receives the Le, the financial institution need certainly to clearly document the new borrower’s purpose so you can proceed having the order. The lender can only just assemble charge, such appraisal charge, immediately after acquiring that it verification (a lender may still gather a genuine credit history percentage prior to searching brand new borrower’s intent so you’re able to go-ahead).

For every user must receive the Video game no less than about three business days just before closing. In the event that certain recommendations throughout the Computer game was altered, the financial institution should provide a revised Cd in the closing dining table. In some points, the three providers-date opinion period must be cast aside.

As opposed to the 1st Basic facts-in-Financing statement and you can Good-faith Guess, individuals will have a new revelation called the Mortgage Imagine (LE)

- Switch to the brand new Annual percentage rate outside of tolerance

- Improvement in the loan device

- Addition regarding a good pre-fee penalty (Wells Fargo doesn’t costs pre-commission penalties to the mortgage loans)

Insights TILA-RESPA’s significance of provided and you will received will help designers and their consumers stop possible timeline shocks. Data files accessible to this new debtor should be:

Instead of the initially Knowledge-in-Financing report and you will Good faith Imagine, borrowers gets an alternate disclosure known as Financing Guess (LE)

- Introduced in person.

- Placed in postal mail.

- Delivered digitally installment loans, Victoria.

As opposed to the initial Basic facts-in-Credit report and you may Good faith Guess, consumers get an alternative disclosure called the Financing Guess (LE)

- When they’re privately on the client’s hands.

One to last resort comes into play with a new date-protecting solution from Wells Fargo Real estate loan: yourLoanTracker SM also provide disclosures, and you can check in the intent to proceed on line. Find out more throughout the yourLoanTracker into the Digital availableness provides mortgage reputation clarity, lower than.