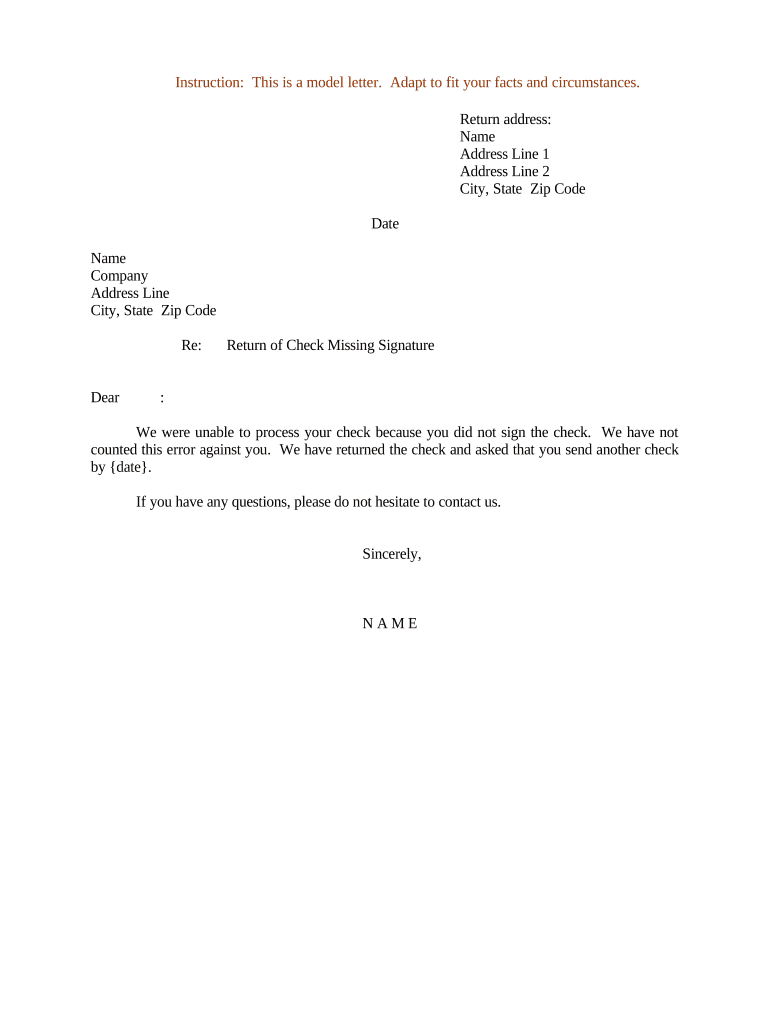

Vendor share limits ranges from 2%-9% based on your loan scenario

26 октомври, 2024

HomeReady finance to allow a huge variety of people to see Fannie mae capital that would otherwise be ineligible with the program. The applying centers on individuals having advanced borrowing from the bank, but have other issues who if not avoid them from getting the mortgage. Usually, this means a high than just acceptance debt proportion. To manufacture right up because of it truth, brand new HomeReady program allows you to use the earnings out of anyone that lifetime at home, together with students, mothers, or other household members. You may play with boarder income in some situations. Yet not, one of many hardest circumstances to cope with on HomeReady loan otherwise any financing, for example, is coming up with brand new downpayment. HomeReady funds need a beneficial step 3% down payment, and that to have lower income individuals, will likely be hard to make, which is why the limitations with the provider efforts try casual to your this program.

Vendor Contributions are allowed

Yet another advantageous asset of this choice would be the fact supplier contributions are allowed, for as long as the bucks they supply purely discusses the closure will cost you and nothing above those will set you back. There are restrict seller share quantity deductible, centered on the LTV and you may possessions style of.

Exactly how Vendor Concessions Really works

In case your seller agrees to pay all of the or a part of your closure charge, like the origination, discount, recording, title, appraisal, and you will operating charges, product sales cost of the house is enhanced. This is done after you agree with an authentic conversion process price to your home. Once that is decideded upon, the lending company gives you a closing pricing price, which you yourself can upcoming negotiate into the seller. The vendor can pick to spend most of the or part of brand new settlement costs. Any kind of amount are decideded upon, you and the vendor commit to improve the conversion cost of your house payday loan Ridgecrest properly. The money more than the real conversion rates determined try just what will get put towards closing costs. You to essential requirement regarding supplier concessions, yet not, is that the home needs to appraise sufficient towards merchant concessions getting included. Given that restrict LTV into HomeReady mortgage was 97%, their appraisal must go back properly.

Consumers do not need to Contribute

One of several book aspects of HomeReady loans is you do not need to put any one of the finance into the mortgage. Very financial apps want no less than a small portion of the loans to be provided with the new debtor, however the HomeReady financing does not require you to definitely. This means that this new advance payment financing may come of some one except that yourself and settlement costs can come about seller.

- If your LTV try 80 % or less, there is absolutely no minimum significance of debtor money on brand new off payment. This is exactly for all the type of unit from one to cuatro tools.

- If your LTV is over 80 per cent, there was nonetheless no minimum need for borrower financing on the down-payment, but it is when it comes to a single device assets just. Towards the 2 to 4-unit services, you need to lead no less than 5% of your fund to your financing.

Recording Provide Money

If you found provide currency towards your HomeReady loan, you ought to file they correctly. It indicates demonstrating that the money is it’s a gift, and never financing which is expected to end up being paid off. If it’s a loan, the lender would need to shape the new costs to your personal debt proportion to determine if you qualify for the borrowed funds into the brand new obligations included.

This new specialized means to fix file current money requires the donor to promote a gift page. The fresh page need certainly to were suggestions for instance the number of the new provide are offered, the newest big date it considering the cash, and an announcement indicating the lending company that it is a present hence there aren’t any installment terminology. Simultaneously, the lending company need to verify the second:

- The fact that the latest donor has the readily available fund within his examining otherwise checking account

- Proof the brand new transfer of your funds from this new donor’s membership into borrower’s account

- A duplicate of one’s canceled view

Brand new HomeReady mortgage provides individuals with plenty of autonomy, not simply due to their income, however with new down payment and you may settlement costs as well. Having the ability to utilize the earnings out of members of the family as well because money from providers in the form of sellers’ concessions helps make the HomeReady financing one of the most sensible loans on the market. When you yourself have excellent borrowing from the bank, yet your debt ratio is actually away from practical criteria so you can be eligible for an excellent QM loan, the new HomeReady mortgage is a fantastic method of getting the fresh financial support you want.