Virtual assistant Re-finance Guidelines To own IRRRL and money-Aside Refinance

16 януари, 2025

Virtual assistant Refinance Guidance involve two line of mortgage processes: the Va improve refinance (IRRRL), and Virtual assistant cash-out refinance. Gustan Cho Partners focuses on assisting people which have rates and you will title Va improve refinances and cash-out Virtual assistant refinance mortgage loans. This short article coverage the new Virtual assistant refinance guidance for Virtual assistant streamlines and cash-out refinance funds, providing important recommendations of these in search of Va home loans.

Just who Qualifies Having A beneficial Va Refinance loan Loan?

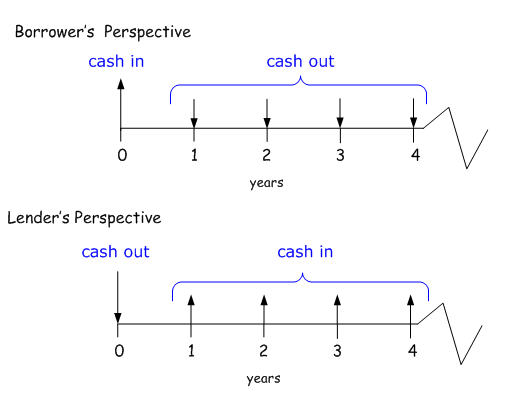

The united states Agency off Experts Facts (VA) claims Va Money, and qualified loan providers will get thing them. Part of the function of Virtual assistant mortgage brokers will be to promote long-identity financing in order to enough time-name money so you can qualified Western pros or the enduring partners once the a lot of time as they do not remarry.

The fundamental goal of the latest Virtual assistant lead mortgage system is to let qualified pros locate a home loan, helping these to buy number 1 residential property to reside without deposit needed.

So you can be eligible for a beneficial Va home loan for selecting or refinancing, you truly must be a recently available active-obligation services member otherwise a retired seasoned with a keen respectable release who meets the minimum army provider criteria to locate an effective Virtual assistant certification out of qualifications. For example providing within the a part of one’s U.S. Equipped Qualities for around 90 successive effective weeks throughout the wartime or perhaps 181 consecutive times of effective military solution through the peacetime. This short article shelter and you can speak about Va Refinance Assistance and no financial overlays.

Va Loan Criteria

The significant advantages of Virtual assistant lenders is giving 100% financing, meaning zero downpayment required. As well, settlement costs would be wrapped in the fresh new seller’s concessions or bank borrowing. Virtual assistant fund will be simply mortgage system that doesn’t need Personal Home loan Insurance policies (PMI) having less than a 20% downpayment.

Under Va refinance advice, veterans have access to 103.3% funding (no PMI) otherwise an excellent 20% next financial doing $6,000 to have times-efficient advancements. New resource payment is even referred to as connect. It will range from 0 to three.3% of your complete loan amount which will be payable to the Va. Nevertheless, it is possible to money that it money payment, always added to new Va loan amount.

Whenever can you re-finance your Virtual assistant mortgage?

Seasoned homebuyers exactly who bought property at the a premier home loan rate on account of with all the way down credit ratings and get remodeled the results after closing on the house should think about refinancing on a lesser rates. Virtual assistant mortgage rates are based on the brand new borrower’s credit ratings. The higher the brand new ratings, the low the borrowed funds prices.

So you’re able to re-finance towards an effective Va mortgage – a home loan supported by the latest Company of Pros Issues – you might be necessary towait no less than 210 months otherwise long enough to are making six repayments, whatever is lengthened. Consult All of our Financing Officer getting Va Loans

For the a home buy, veterans can borrow up to 103.3% of one’s sales speed otherwise appraised well worth, whatever was faster. As a result of the lack of month-to-month PMI, significantly more mortgage payments wade really towards qualifying with the amount borrowed, enabling large loans with the exact same payment. According to Va Refinance Advice, veterans will get use doing 100% of the home’s realistic well worth whenever an alternate Virtual assistant mortgage try written, at the mercy of state laws and regulations. Virtual assistant Lenders provide this type of versatile borrowing from the bank choices to personal loans in Connecticut qualified veterans.

Refinancing A current Virtual assistant Financing To some other Va Streamline

Whenever refinancing which have a Va loan to a different Virtual assistant loan (IRRRL Refinance), the debtor ount. The extra 0.5% money fee are of a great Va Interest rate Prevention Re-finance. This web site focuses primarily on Va refinancing. Va home loans create experts to help you be eligible for larger financing number than traditional Federal national mortgage association/conforming finance, offering a very important benefit to the courageous group providing regarding the military, and this aligns which have Virtual assistant refinance direction.