We come strengthening our borrowing of scrape

21 ноември, 2024

Representative hyperlinks on the affairs in this article are from couples that make up us (select the marketer disclosure with the set of couples for more details). Yet not, all of our opinions are our personal. Observe i rate mortgage loans to enter unbiased product reviews.

- My spouce and i had been each other raised into Dave Ramsey’s zero-obligations money pointers.

- When we decided to go to pick all of our first home, we were stuck – we did not have credit ratings.

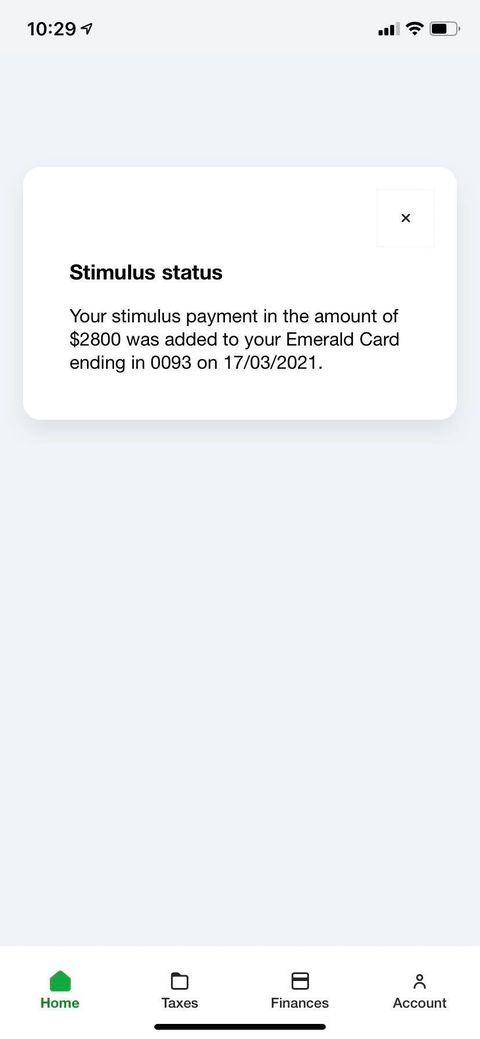

- We grabbed out a protected bank card to create all of our rating and you may was able to purchase a property in the 2021.

We grew up enjoying Dave Ramsey’s broadcast let you know in my parents’ car. Appear to citing their own trust and you may hitting the right notes from private obligations, Ramsey provides big desire inside the old-fashioned Religious groups.

Ramsey’s private loans advice is actually famously according to paying and you will existence off obligations no matter what. Ramsey’s audience call-in and you will, immediately after explaining the way they paid its personal debt following Ramsey’s recommendations, cry, „We’re Obligations-100 % free.“

On the surface, advice to keep regarding personal debt looks practical as well as needed. Ramsey rails, in particular, against credit card debt, regardless if that makes up around $step three,000 of the $fifty,000 debt an average Western owes.

Increasing right up, the newest the quantity of your economic advice I obtained were to fool around with this new envelope system (providing the salary out in dollars and you can separating the cash on envelopes for each and every sounding your budget so you can image your own expenses) and avoid handmade cards.

My better half in addition to grew up that have mothers whom heard Dave Ramsey. When we reached our very own mid-20s and come thinking about to order a home, neither of us got handmade cards, car money, otherwise a reputation using student loans (I have not yet graduated, and i also sit-in an inexpensive condition university). If you find yourself that was mostly the great thing, sadly, it meant that we including didn’t have fico scores – some thing Ramsey calls an enthusiastic „I enjoy financial obligation“ rating.

Talking-to financing officials of numerous mortgage lenders, I discovered that that have a credit rating got fairly extremely important to buying a property! It is extremely difficult without it. Having good nonexistent credit score, I did not actually become approved for a regular credit card.

To create borrowing from the bank from nothing, i had a protected credit card, hence expected in initial deposit of some hundred or so bucks. I place our power bills into bank card after which paid off it off every month. They grabbed all of us a small over a-year to locate our very own fico scores high enough to let us to remove an excellent mortgage.

When my spouce and i chatted about all of our americash loans Wiggins plans to get a house with the families, and mentioned exactly how we had gathered our very own borrowing from the bank doing thus, we were amazed to face a tiny disapproval. You to loved one said Ramsey’s pointers, which is to keep offered and you may pay for property during the cash.

We bankrupt along the things: Early in 2021, whenever we have been willing to buy, the typical price of a property in the usa is actually over $three hundred,000. They had removed you five years off demanding cost management to store right up $sixty,000 (many of which we would play with due to the fact a deposit). It might grab even more ages to keep upwards sufficient to buy a moderate home from inside the cash if the elizabeth. Yet not, the market industry do absolutely outpace all of us – a year later, an average cost of a house is $365,000.

Debt may have a beneficial chokehold on your own finances as well as your coming; the average American adult provides more $fifty,000 with debt, including mortgages, college student, automobile, and personal funds

No matter that people try responsible with this money and build an excellent monetary choices. Brand new math will not seem sensible such that will make to purchase a house inside cash possible for you, now or perhaps in the long run.

Inside fairness so you’re able to Ramsey, he does not totally condemn mortgages just how he do most other form of financial obligation. The guy actually advises home financing company that provides no-credit recognition for folks who see almost every other standards. But these conditions include a good 20% advance payment and you can an excellent fifteen-12 months home loan in lieu of a thirty-season financial, increasing your payment per month. After which, although and come up with a higher mortgage repayment, Ramsey suggests that your particular construction will set you back (also tools, taxes, and HOA charges) ought not to exceed 25% of the monthly need-house pay.

This advice cannot complement performing-class someone

Because the a functional-class individual like other out-of his listeners, much of his advice seems out-of reach with my existence and you will perform place homeownership out-of-reach permanently basically accompanied it. Purchasing property in the money is scarcely an alternative but toward a bit wealthy.

At the same time, he stigmatizes genuine pathways give, such as which have a credit rating built on years of in charge credit explore. I am aware out of my personal upbringing one to their opinions manage a society of little finger-directing and wisdom about cash actually one of individuals too worst for his recommendations to-be appropriate.

Homeownership is just one of the how can i getting upwardly mobile and you may split schedules from poverty, even though you do not see Dave Ramsey or their listeners’ standards. Within my go purchase a property, I watched certainly you to Ramsey’s advice isnt given with my things – otherwise my victory – in your mind.

Wanting an economic advisor need not be tough. SmartAsset’s totally free product matches you with to around three fiduciary financial advisors one serve your neighborhood in minutes. Per advisor could have been vetted by SmartAsset and is kept to help you a fiduciary simple to do something in your desires. Initiate your pursuit today.