What goes on If you fail to Pay-off Payday loans?

16 декември, 2024

The common cash advance in 2023 was $375, depending on the Pew Trusts. The average interest otherwise loans costs because pay day lenders refer to they to have good $375 mortgage would be ranging from $ and http://cashadvancecompass.com/payday-loans-ia/ $75, according to the terms.

The interest/loans charge normally are between 15% and you will 20%, with regards to the financial, but could feel large. Condition laws handle the maximum appeal a payday bank can charge.

Out-of an analytical viewpoint, it appears as though it to have good fifteen% loan: 375 x .fifteen = . For those who acknowledged regards to $20 for each and every $100 lent (20%), it can appear to be it: 375 x .20 = 75.

Which means you ought to spend $ so you can obtain $375. That is mortgage loan out of 391% Annual percentage rate. For people who spend $20 for every single $100 lent, you pay a financing charges regarding $75 and you can an interest rate out-of 521% Annual percentage rate.

When the a customer can not meet the several-day due date to have cost, capable ask the lending company so you’re able to roll over the loan. In the event your condition lets it, the fresh new borrower only pays any kind of fees are owed, while the loan are longer. Although desire grows, as the carry out funds charges.

Utilising the reasonable finance charge readily available ($fifteen for each and every $100 borrowed) towards the a beneficial $375 loan, the customer owes a financing fees off $ to possess a whole loan amount out of $.

Whenever they chose to roll over the latest payday loans, brand new matter will be $. That is the loan amount $, and additionally finance charges out-of $ = $.

What is actually a good Rollover Mortgage?

When you are unable to pay-off the money lent within fourteen days, the financial institution tend to renew the borrowed funds generally for another 14 days. That’s a beneficial rollover mortgage. But far better notice it as the earliest rumblings away from a great monetary avalanche.

The fresh debtor still owes the fresh a great principal therefore the attention towards that dominant but now far more for the money fees. You are fundamentally recharged a fee for the decrease for the investing straight back the initial mortgage.

Would Payday loans Apply at My Borrowing

Pay day loan providers you should never examine borrowers’ credit ratings just before advancing financing. Correctly, they don’t normally declaration one facts about pay day loan borrowing so you can new across the country credit reporting people.

If you have a keen upside so you’re able to doing business with a low-antique financial whom charges too much interest levels, it initiate and comes to an end around.

Brand new CFPB advises that if you try not to pay the loan back in addition to financial turns your delinquency out to a financial obligation enthusiast, although not, one to personal debt collector you certainly will declaration your debt to help you a national borrowing revealing company. And that carry out apply at your credit score.

There’s another circumstance where an unpaid payday loans personal debt you may apply at your credit rating: a lender successful a lawsuit against you more an outstanding financing you will definitely appear on your credit history and you may destroy their score.

Pay day loan Possibilities

Several mil American customers score payday loans on a yearly basis, despite the reasonable evidence one to cash advance send very borrowers better on personal debt.

You’ll find possibilities to help you pay day loansmunity companies, churches and personal causes will be first place to test to have let. If it can not work, listed here are a lot more possibilities worthy of contrasting.

Paycheck get better: Many companies bring group a way to receive money it acquired prior to its income flow from. Instance, in the event the an employee worked 7 days in addition to next booked salary is not due for another 5 days, the business will pay brand new staff member toward seven days. That isn’t that loan. It might be subtracted in the event that next pay-day arrives. If your team does not offer this, you can travel to an advance loan app.

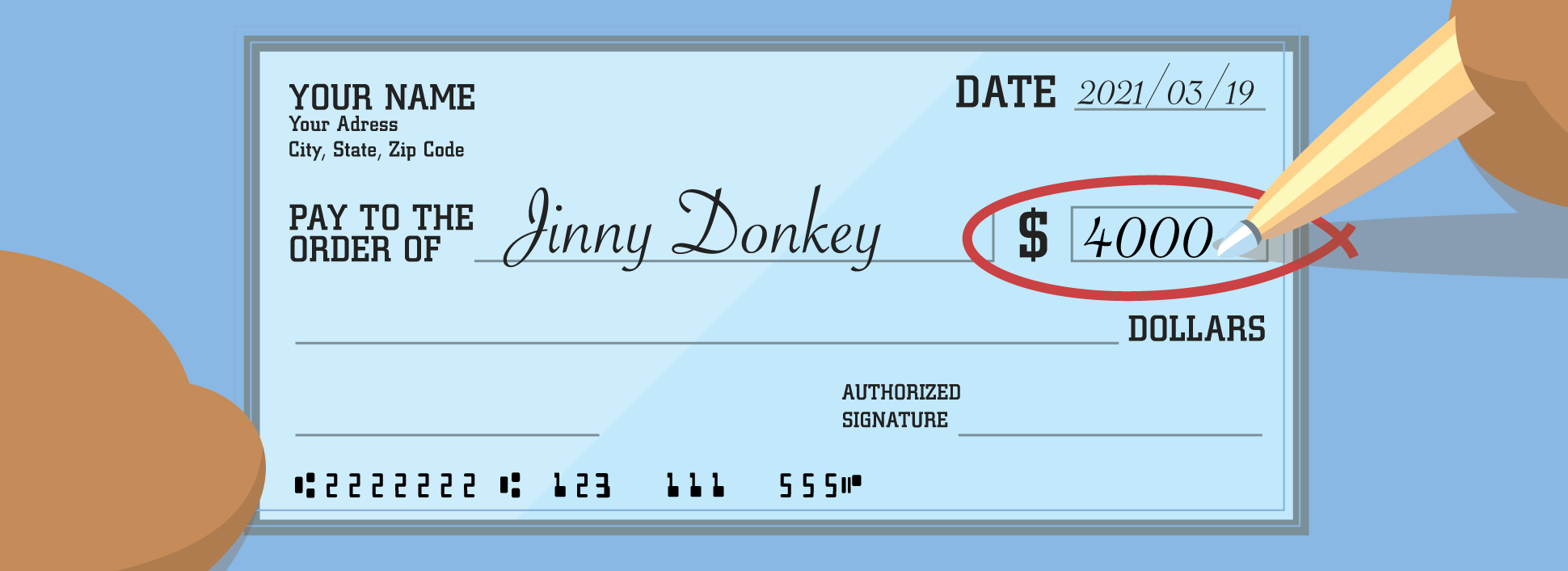

Acquire of household members or friends: Borrowing money from family unit members otherwise family unit members is actually a fast and much economical treatment for look yourself of issues. You would expect to invest a reduced rate of interest and has a far more good-sized timeframe than just two weeks to blow regarding a loan, however, to eliminate sabotaging a friendship or relationship ensure that so it are a business price which makes both sides pleased. Draw up a contract which makes the fresh new regards to the borrowed funds clear. And you will stay with it.