Why does property Guarantee Financing Are employed in Michigan?

30 октомври, 2024

A home security financing can help you influence your house collateral for cash. For the family equity you’ve accumulated due to the fact collateral, it’s more straightforward to borrow funds having good words.

Griffin Resource also offers Michigan household security funds with aggressive costs. Observe how a HELOAN works and you will learn whether tapping into your property equity ‘s the proper choice to you.

Once you sign up for property collateral loan during the Michigan, you happen to be utilizing your family just like the equity to carry out a protected mortgage. Since the you may have collateral in the event you can not pay back the loan, it’s simpler to get access to money you could have an excellent difficult time credit if not.

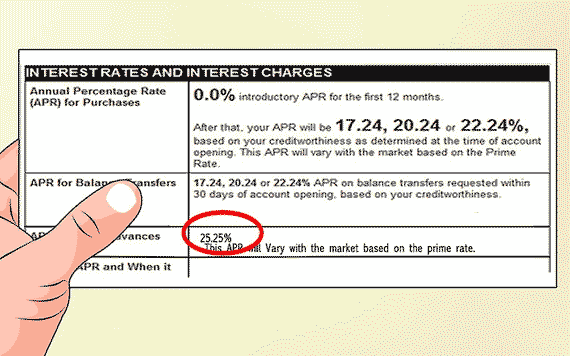

Just like the family security mortgage rates inside Michigan tend to be lower versus playing cards and private money, they’re a smart choice if you are a citizen which desires funds a huge expense, whether it is an unexpected emergency statement or home improvements you to enhance the worth of your property. A great Michigan home security loan is also recommended if you would like combine large notice personal debt.

After you’ve built-up adequate guarantee in your home , you might apply for a property security financing . Lenders typically allow you to borrow as much as 95 percent of the equity you have got of your house, which includes means brand new limit during the 80 %. For people who have not paid back the loan from in full by time you promote your home, your debts may come from the domestic marketing.

Applying for a home guarantee loan when you look at the Michigan generally begins with bringing very important monetary pointers particularly evidence of income. Tax returns typically serve as proof income, you could as well as submit an application for a zero doc house guarantee loan through Griffin Investment if you are notice-operating.

Style of Family Equity Loans

Deciding on the best mortgage according to your role is very important. There are 2 different varieties of home security fund – family collateral money (HELOANs) and you may household equity lines of credit (HELOCs).

A home guarantee mortgage is a straightforward fixed-rates loan. As long as you have sufficient equity of your house, you could potentially apply for a great HELOAN. Your bank often funds the loan in a single lump sum payment, and you might routinely have somewhere between four and you may forty years so you can pay it off. Loan providers generally speaking need you to provides five in order to 20 percent security to acquire a loan, which enables one acquire around ninety % of household collateral.

Property security line of credit is a bit not the same as a traditional family equity loan. Lenders gives you a-flat expenses maximum predicated on your own residence’s worthy of and just how much guarantee you have. You could potentially spend so it money particularly you’d have fun with credit cards, and your payment per month was determined by just how much your invest one to few days. HELOC costs within the Michigan are variable, so that your interest can go up or down centered on business criteria.

There is no incorrect respond to while choosing ranging from a good HELOC and HELOAN. However, it is very important check out the positives and negatives of various versions out-of financing before deciding.

Pros and cons from Michigan Household Security Money

Before applying to own a property equity financing, you ought to weigh the advantages in place of the potential risks you’re facing. Domestic loan places Louisville security loans should be a device if you use all of them sensibly, but some tips about what you need to know earliest:

- You can get accessibility cash to have family renovations, scientific costs, and

- Griffin Investment has the benefit of aggressive domestic collateral mortgage cost during the Michigan toward first houses, second house, and you may money functions

- You don’t have to sacrifice your reduced-speed home loan

- Michigan family security loan prices become lowest when compared to playing cards and personal funds

- You can potentially dismiss family guarantee loan appeal on your taxes

- HELOANs and HELOCs add to your overall debt burden

- A great HELOC can lead to irresponsible purchasing if not pertain having a strategy set up

- Failing to pay back your loan can cause losing the household

You’ll find risks in terms of Michigan household security finance, but it’s about are an accountable borrower. Dont acquire more you can afford to repay, and make sure you will be with your money to have something that you you want in lieu of something that you wanted.

It’s also advisable to consider HELOAN and you will domestic equity credit line pricing when you look at the Michigan before you apply for a loan. Do your research and start to become disciplined and you can get more from your own home equity financing.

Michigan Family Security Mortgage Qualification Standards

Taking acknowledged getting a home collateral loan is easier than simply you might imagine, however, you can still find requirements you should meet. Here you will find the about three significant standards loan providers glance at after you submit an application for a house equity financing:

- You usually need to have at the least 20 percent equity for the your property to obtain approved for a financial loan. Generally, after you’ve received cash from your home collateral financing, you ought to remain no less than five in order to fifteen % security in order to be considered.

While you are being unsure of regardless if you are entitled to a property security mortgage from inside the Michigan, contact all of us right now to explore if or not you be considered. You’ll be able to use the Griffin Silver app evaluate financing solutions, build a spending budget, display screen the credit, and make sure you’re on track to locate accepted to have an effective household collateral loan.

Make an application for a house Security Mortgage within the Michigan

Taking right out a home equity loan would be a smart choice to obtaining credit cards or private loanparatively reasonable rates and you may lengthened loan periods helps make domestic security funds simpler to repay.

With respect to household equity funds, Griffin Investment renders some thing effortless. You can submit an application for a home equity loan on the all of our site otherwise contact us for more information on our very own loan options. Whenever you are prepared to tap into the home’s guarantee, submit an application for a Michigan domestic equity mortgage that have Griffin Financing today.